Are you questioning whether or not you must look ahead to rates of interest to fall additional earlier than shopping for a house? If that’s the case, you’re not alone. Darren Polson helps a reader with an enormous transferring resolution…

Signal as much as our e-newsletter

Subscribe

The Query

The Query

My spouse and I are planning to purchase a house. We offered our final property as we would have liked to relocate to the south of England, and we’ve been renting while we resolve what to do. We’re nonetheless undecided, as we’ve now heard tales rates of interest my fall as little as 2.75% by the top of the 12 months.

If we wait until then, we concern property costs may enhance and this may be a double blow if there was no change to rates of interest. However, equally, would we kick ourselves if we transfer now and charges plummet. What ought to we do?

Darren’s Reply

I can perceive why you’re asking, and this can be a troublesome resolution. Properties will fluctuate and costs are transferring upwards, however that is depending on location and property kind.

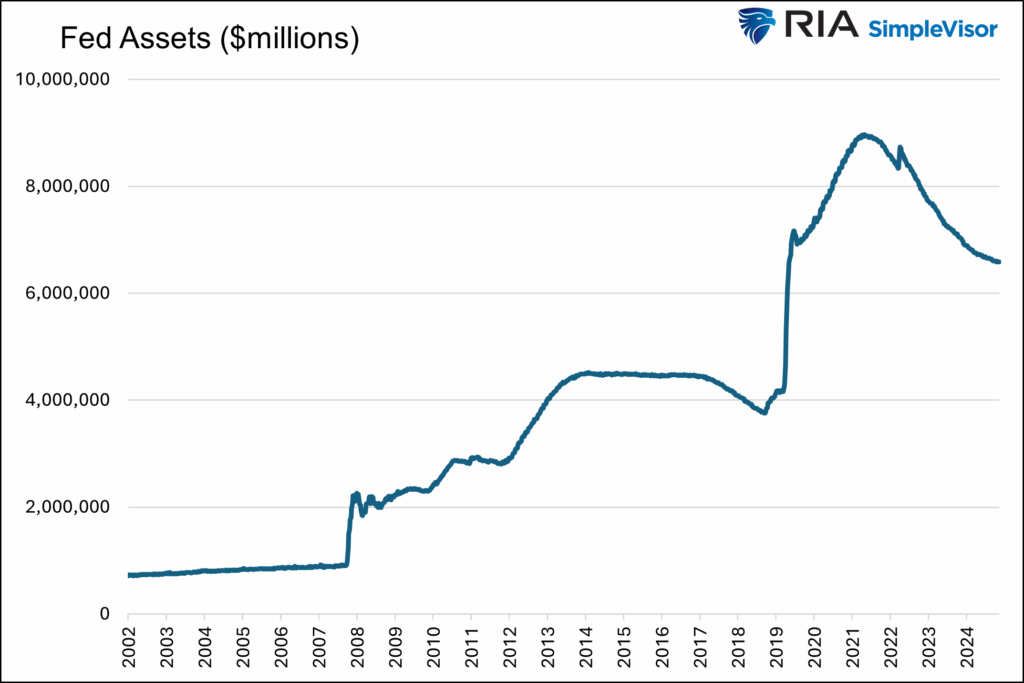

Predicting charges is troublesome given the variety of financial components that may impression charges. Banks aren’t depending on the Financial institution of England (BoE) Base Charge as they’ll use swap charges when taking a look at mortgage lending.

Nonetheless, reductions do give lenders confidence. A lot of them have already factored in charges lowering and this was evident with many lenders lowering charges all through April.

Optimism has elevated barely with predictions of additional BoE base price drops after the newest one on 8 Could.

ADVERTISEMENT

The larger query now’s how this all performs out. Will we get one other reduce in August and/or November? Will or not it’s two or three cuts this 12 months? Time will inform…

The easy fact is, if it’s the appropriate house for you then it’s the appropriate time!

Given your present state of affairs as renters, you could discover that the price of your hire is larger than a mortgage fee, which can imply that it’s going to prevent cash to maneuver and start paying your individual mortgage.

I’d advise chatting with a dealer who can test charges and offers based mostly in your circumstances. This can actually provide help to to make a extra knowledgeable resolution.

A dealer can provide you an thought of what you possibly can borrow, and this gives you confidence to start your property search.

Copyright David Johnstone Pictures

Copyright David Johnstone Pictures

Meet our skilled…

Darren Polson is head of mortgage operations at Aberdein Considine. He has been writing a daily column for What Mortgage for over two years and is now right here to reply YOUR questions.

In case you have a query for Darren please electronic mail kate.saines@emap.com or go away a message within the feedback beneath.