How Early Well being Insurance coverage Funding Builds Wealth Safety

Investing in medical insurance early is just not solely about overlaying medical payments. Additionally it is about laying the inspiration for long-term wealth safety and monetary peace of thoughts. With medical insurance funding, you’ll be able to safe dependable protection even earlier than sickness strikes. You possibly can protect your financial savings and protect your self from probably catastrophic bills throughout medical emergencies.

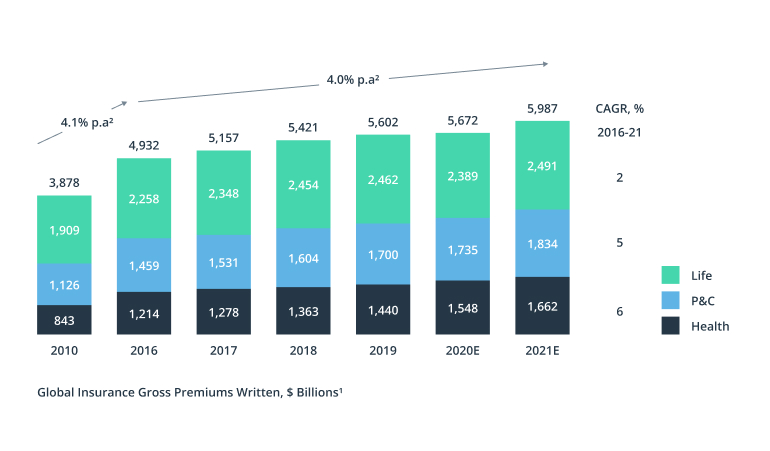

Healthcare prices are escalating considerably, and each premium you pay for medical insurance may be thought-about a tiny funding in direction of stability. Medical health insurance has grow to be a vital pillar of wealth safety, supporting your total future.

This weblog covers particulars about medical insurance, together with particulars like how these plans work, wealth safety advantages, early funding benefits, and extra.

Why Well being Insurance coverage Ought to Be Seen as an Funding

One widespread query many individuals ask is, ‘Is medical insurance an funding?’. The reply is sure. Medical health insurance is unquestionably an funding. The explanations are:

| Causes | Particulars |

| Broader protection and decrease premiums when bought early | If you buy medical insurance if you find yourself younger, you need to pay decrease premiums. This implies saving on funds.

Additionally, there are fewer exclusions for pre-existing situations. It’s attainable to entry higher protection for costly well being points. |

| Safety towards surging medical bills | Medical inflation is surging. Surgical procedures, hospitalisation, and medicine are getting costly with every passing day.

Medical health insurance funding plans save your financial savings from unprecedentedly big payments throughout emergencies. |

| Monetary stability and peace of thoughts | You possibly can plan your life confidently figuring out that you’re coated for main well being dangers. |

| No declare bonuses and rewards | Many medical insurance insurance policies provide no-claim bonuses. By not making claims, you may get reductions on premiums or get pleasure from an elevated sum insured. This not directly helps you get monetary savings with decrease premium funds. |

| Tax advantages and financial savings | Medical health insurance premiums in India provide tax deductions beneath Part 80D. This minimises the taxable earnings and helps you save on premiums. |

How Does Insurance coverage Funding Work?

Here’s a step-by-step breakdown of how does insurance coverage funding works.

You select a medical insurance coverage and pay a premium

You select a medical insurance coverage and pay common premiums to the insurer. The insurance coverage firm bears the medical bills throughout a medical emergency.

You get the protection and advantages

The companies that you’re going to get will rely on the medical insurance coverage you’ve chosen. Totally different insurance policies have totally different companies, like hospitalisation, preventive care, diagnostics, medicines, physician visits, and so forth.

In case of pre-existing well being situations, there could also be ready durations to avail full advantages.

Claims course of: reimbursement vs cashless

There are two processes for declare settlement: cashless and reimbursement.

If you’re hospitalised within the insurer’s community hospitals, the insurer settles the payments with the hospital straight. This cashless facility minimises the upfront outlay.

Nonetheless, in different circumstances, you’ll be able to pay the payments and later submit the payments and receipts to the insurer for reimbursement. The coated bills shall be as per coverage phrases.

Out-of-pocket bills

Generally, you might need to pay deductibles, co-payments, or sure prices comparable to room lease limits, some medicines, medical gear, and so forth., which might be past the coverage protection.

Well being Insurance coverage with Funding Plans in India

Some of the sought-after monetary merchandise that’s in excessive demand in India is a mixture of medical insurance plus funding plan. Generally known as unit-linked well being plans (ULHPs), they mix medical insurance and numerous different funding elements.

The premium paid for such medical insurance with funding plans will get divided into parts.

- Funding funds: One a part of the premium goes into funding funds like bonds, shares, fairness, and mutual funds. The policyholder can spend money on funds of their selection, relying on funding objectives and danger urge for food.

The worth of this funding half will differ relying on the efficiency of the invested funds. When the funds carry out nicely, the funding grows.

- Well being protection: The opposite a part of the premium goes in direction of offering well being protection for medical bills like hospitalisation, essential sickness protection, day care, surgical procedures, outpatient bills, and extra.

The protection and premium quantity of the medical insurance half will rely on the age, well being situation, and sort of protection that the policyholder desires.

The vast majority of main insurance coverage firms in India provide complete medical insurance plus funding plans for purchasers.

Lengthy-Time period Wealth Safety Advantages

Are you interested by figuring out concerning the long-term wealth safety advantages of medical insurance plans? Listed here are among the most essential ones:

| Advantages | Particulars |

| Predictable premiums and prices |

|

| Monetary leverage and tax financial savings |

|

| Safety of financial savings and property |

|

Early Funding Benefit

In India, you’ll be able to select a solo medical insurance funding or a mixture of medical insurance plus funding plan. Regardless of the funding plan, just be sure you make investments as early as attainable. Listed here are some early funding benefits in medical insurance plans:

| Advantages | Particulars |

| Wider and higher protection selections | Youthful individuals have selections for extra plans with higher choices for sum insured, wellness perks, add-ons, and extra. Ageing reduces the alternatives. |

| Decrease premiums | In the event you take a medical insurance plan early, the premium is sort of low. Insurers assume decrease well being dangers in youthful individuals. |

| Tax financial savings over a few years | Tax deductions are relevant for premium funds of medical insurance. In the event you begin early, you get the advantages for extra years, saving cash in the long term. |

| Simpler approval and fewer rejections | It’s unlikely to have critical well being points early in life. This means negligible probabilities of getting rejected or having exclusions imposed. |

| Safety towards surging medical bills | Yearly, healthcare prices improve attributable to remedy, drugs, and hospitalisation prices. Early medical insurance affords safety towards these future surges. |

| Finishing ready durations sooner | Medical health insurance insurance policies usually have ready durations for sure situations or remedies. Whenever you buy the medical insurance early, you get to finish these ready durations when you are wholesome. |

| Loyalty rewards and no-claim bonuses | You have to begin early to construct up loyalty rewards and no-claim bonuses. With the bonuses, you’ll be able to decrease your renewals, get pleasure from added perks, and improve the protection. |

Issues to Contemplate Earlier than Selecting a Well being Insurance coverage Funding Plan

Selecting the best medical insurance funding plan is a difficult job, with so many choices to select from. Listed here are some important components you will need to verify earlier than finalising on a plan:

- Sum insured/protection quantity: Be certain that the sum insured can cowl high-cost remedies, medical inflation, and costly metropolis hospital charges. The protection ought to match your loved ones measurement, well being dangers, and monetary capability.

- Hospital community and cashless facility: Earlier than buying the medical insurance, verify the hospital community with which they’re related. Getting remedy at a community hospital facilitates cashless remedy. This declare settlement takes place between the hospital and the insurance coverage supplier.

- Premium quantity and companies supplied: Individuals usually select medical insurance funding with a low premium quantity. Nonetheless, in such insurance policies, you may not get numerous companies. Examine premiums throughout numerous insurance policies, together with the companies you’re going to get.

- Inclusions and exclusions: Verify the companies which might be coated within the coverage, pre and post-hospitalisation, day care, maternity, ambulance prices, AYUSH, and so forth. Additionally, ask concerning the exclusions, as some insurance policies exclude sure remedies, sicknesses, or medical elements.

- Declare settlement ratio and insurer fame: Enquire concerning the declare settlement ratio and the success price of the insurer. See how easily the insurer handles the claims. Search for insurers with excessive declare settlement ratios.

Conclusion

Early medical insurance funding helps safe your future bodily in addition to financially. As soon as your well being is insured with a dependable medical insurance coverage, you’ll be able to plan investments for different sectors like training, retirement, house, and extra. In the long term, you construct a basis for wealth safety.

At ManipalCigna Well being Insurance coverage, you’ll be able to select from all kinds of medical insurance funding plans, with assorted options and advantages. Flick through the plans and choose the one that most closely fits your necessities. The insurance coverage supplier affords complete medical insurance plans for each section of life with fast declare settlements, an in depth community of hospitals, round the clock customer support, and extra. Insure your well being and revel in peace of thoughts with the superb medical insurance insurance policies supplied by ManipalCigna Well being Insurance coverage.

FAQs

What’s medical insurance with funding advantages?

A medical insurance plan with funding advantages is a hybrid coverage combining medical insurance protection and investments in numerous monetary devices like bonds, funds, or equities. The coverage is just not a pure insurance coverage plan however has a powerful funding angle.

Which plan provides advantages of each insurance coverage and funding?

There are unit-linked well being plans (ULHPs) that mix medical insurance and numerous different funding elements. These plans provide advantages for each the funding and insurance policy concurrently. The premium paid can also be channelised in each segments.

Is it good to spend money on medical insurance?

Sure, it’s extremely advisable to spend money on medical insurance. In truth, insurance coverage consultants advise buying a medical insurance coverage at an early age for the quite a few advantages that include it. Medical health insurance not solely gives protection throughout medical emergencies but in addition affords peace of thoughts. Additionally it is a terrific step in direction of constructing wealth safety.

,