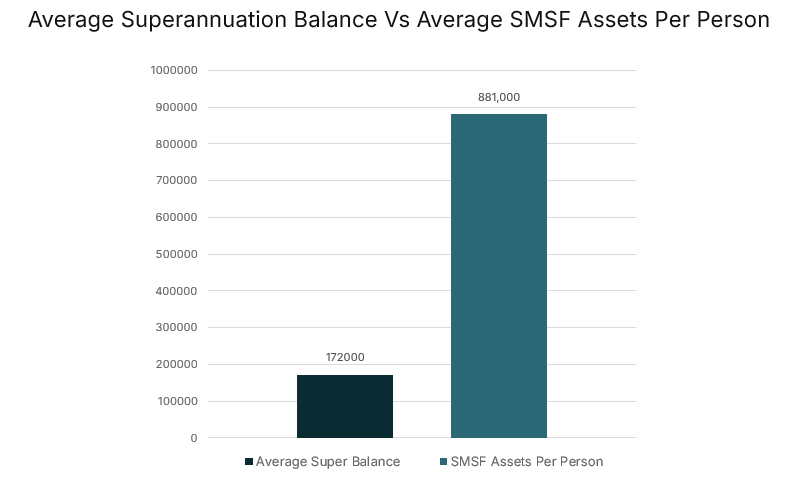

As of final week, the typical Australian holds an excellent steadiness simply over $172,000 with assured predictions for sturdy ongoing development.

In the meantime, the information is even higher for SMSF members, with the most recent ATO knowledge reporting the typical SMSF steadiness is sort of $1.9million and common worth of property per member $881,000.

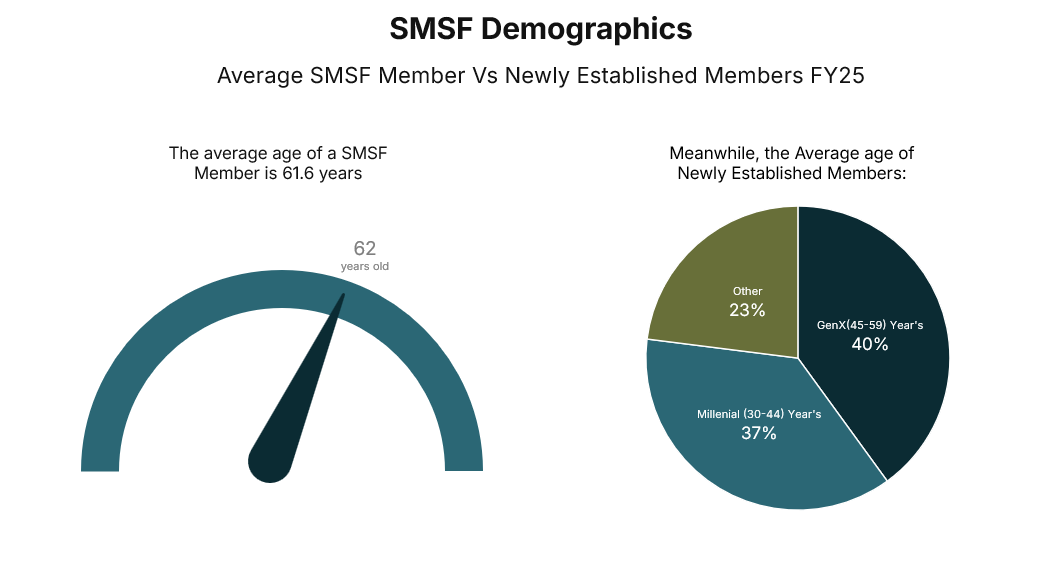

Certainly, knowledge finds persistently sturdy monetary efficiency from the SMSF sector continues to draw extra and youthful members. The Annual Benchmark Report printed by Class Tremendous final month reviews the strongest development of SMSF in eight years, with roughly 42,000 new funds. This is a rise of SMSF members by 6.4% since FY2017.

Information from this era exhibits extra, and youthful Aussies switching to SMSFs earlier of their retirement planning; the typical beginning steadiness of probably the most just lately established SMSF Funds is down from $515,000 to $363,000 – a drop of 30%. In the meantime, the proprietor of a newly established fund is probably to be of GenX (40%) and Millennials (37.3%) in distinction to the typical age of a SMSF member, which is presently practically 62 years outdated.

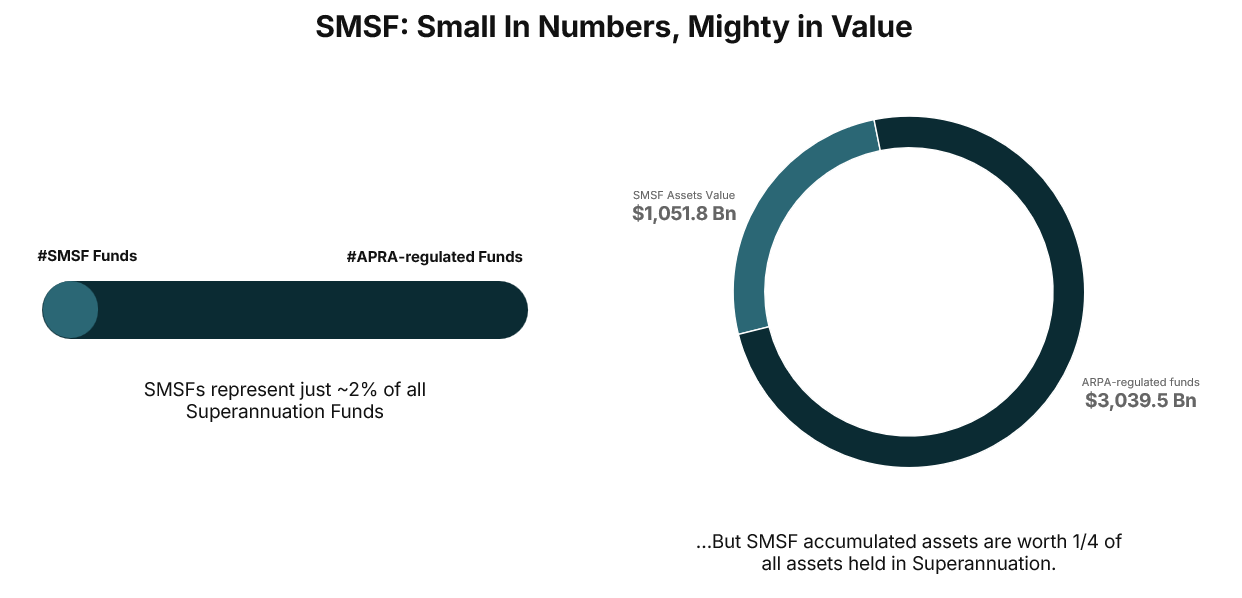

ATO knowledge exhibits SMSFs are held by 1.2Million Australians, accumulatively holding property value $1.05Trillion (up 4.8% on earlier quarter). Despite the fact that SMSFs are solely held by a small share of Aussies, at lower than 2%, the worth held by SMSFs characterize 24% of all Superannuation property.

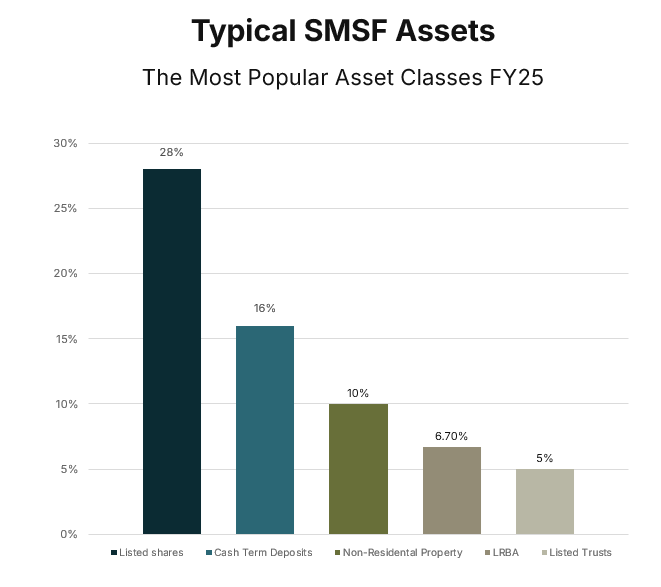

Typical SMSF Investments

Property sometimes held by SMSFs stay regular, with listed shares being the preferred asset class (28% of whole estimated SMSF property) and money time period deposits (16%). The third hottest funding with SMSF members is in non-residential actual property (10%). Class Software program reviews a slight drop in property allocations and direct investments within the final 12months, suggesting that is reflective of efforts to scale back the impacts of DIV 296 laws earlier than it was reformed by the Albanese Authorities earlier this month.

Class Software program additionally recognized 6.7% of SMSFs impacted by Division 296 as having inadequate liquidity to fulfill their liabilities, up from 5% in 2024, highlighting the significance of correct asset and funding administration and retirement planning.

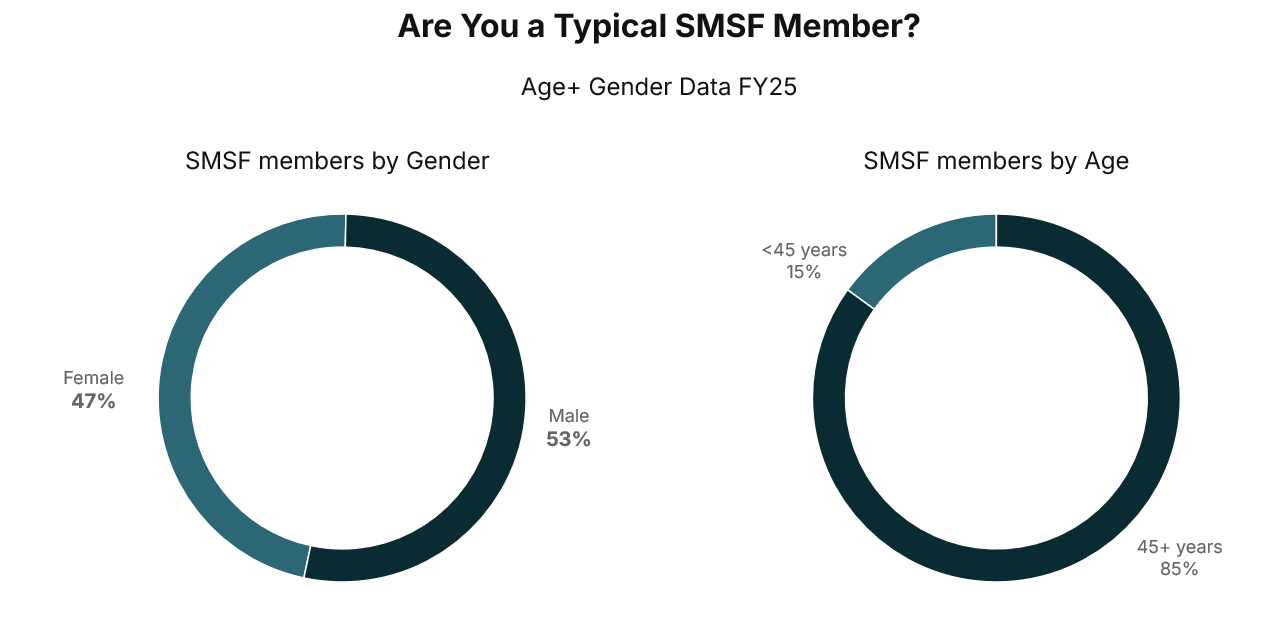

In FY2025, the typical SMSF Member is:

- 61.6 years outdated

- Male (53%)

- Feminine 47%

Most (85%) of SMSFs are held by people who find themselves 45-plus. Nevertheless, these with a newly established SMSF fund are extra usually Gen X – aged between 45-59 – or Millennials, who’re between 30-44 years of age.

The commonest property held in a SMSF in 2025:

- Listed shares (approx. 26-28 % of property

- Money/time period deposits ~16%

- Non-Residential Property 10%

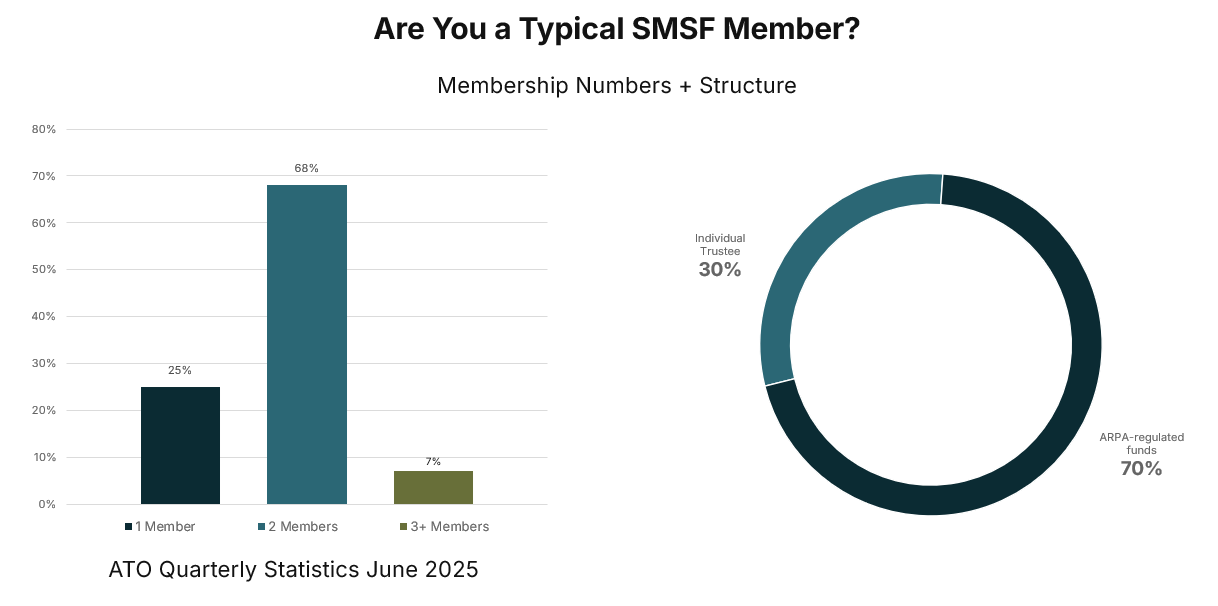

Memberships + Construction

- Roughly 68% of SMSFs have two members – sometimes an older married couple;

- 25% have one member

- Simply lower than 7% have three or 4 members.

In FY25, 70% of SMSF have a company trustee, up from 68% in FY24.

Conclusion

These newest figures exhibit that SMSFs proceed to be a automobile for bigger balances for sometimes older members.

The “common per member” and worth per-fund numbers are nicely above typical retail or trade fund balances. Nevertheless, with extra SMSF members than ever earlier than, and beginning balances dropping by 30%, the huge distances we see when evaluating SMSFs and APRA-regulated funds could shrink and thus, grow to be extra significant.