We frequently get requested the distinction between time-weighted versus money-weighted (or dollar-weighted) returns when calculating portfolio efficiency. On this weblog, we are going to clarify the variations between each, and why Sharesight makes use of the money-weighted methodology when calculating your portfolio efficiency.

Time-weighted returns

Time-weighted returns (TWR) are a approach to measure the efficiency of an funding independently of money flows in or out of the account. This makes this measurement ultimate for calculating the efficiency of broad market indices or the affect of a fund supervisor on the efficiency of an funding. For that reason, it’s typically utilized by skilled portfolio managers to point out how nicely the portfolio’s underlying investments carried out, reasonably than how a lot cash the investor added or withdrew.

At its core, a time-weighted fee of return breaks up the portfolio efficiency throughout the measurement interval into smaller ‘sub-periods’ at any time when there may be an influx or outflow for the portfolio. Then the efficiency of every sub-period is calculated, earlier than being linked to seek out the ‘geometric imply’ efficiency throughout the whole interval. If money flows into or out of the portfolio throughout a sub-period, the interval is damaged down into smaller intervals at this level to calculate the efficiency for every intra-period earlier than then being mixed to calculate efficiency for the sub-period.

Cash-weighted returns

Cash-weighted returns (MWR) measures the efficiency of an funding taking into consideration all money flows: deposits, withdrawals, and the timing of these flows. This methodology of measurement takes into consideration each the dimensions and timing of money flows out and in of an funding portfolio, putting a larger weight on intervals when the portfolio measurement is largest.

For the overwhelming majority of traders, that is the perfect methodology of measuring portfolio efficiency as you management the inflows and outflows of the portfolio. Primarily, it exhibits the precise return you made based mostly on the funding selections you made, reasonably than simply how your investments carried out.

What are thought-about inflows and outflows from a portfolio?

Outflows embrace:

- The worth paid for any funding

- Reinvested dividends or curiosity (value paid for any DRP/DRIP purchases)

- Withdrawals (money faraway from the portfolio by the investor).

Inflows embrace:

- The proceeds from any funding offered (money that continues to be within the portfolio from any shares offered)

- Dividends or curiosity obtained (money earned from investments)

- Contributions (money injected into the portfolio.

Be aware: If there aren’t any money flows in or out of the portfolio through the interval of measurement, each money-weighted and time-weighted charges of return would be the identical.

Time vs. money-weighted returns: An instance

To assist clarify the distinction between time-weighted and money-weighted returns, let’s think about an investor who made three trades in a selected inventory over a interval of two years. Let’s assume that:

- On December 1st 2015, the investor invested $1,000 to purchase 1,000 models of StockABC at $1.00 per share.

- On December 1st 2016, they purchased one other 1,000 models of StockABC at a value of $2.00 per share (spending $2,000).

- On December 1st 2017 the investor offered their total holding of two,000 StockABC shares after the value fell to $1.25.

On this situation the investor misplaced $500 on this portfolio over the 2 years.

Right here’s how the return numbers for every of those efficiency methodologies differ on this occasion:

- Cash-weighted return: -12.77% p.a.

- Time-weighted (CAGR) return: 11.80% p.a.

Regardless of the investor shedding cash on the portfolio, the time-weighted return was constructive. It’s because the time-weighted return is simply measuring the underlying efficiency of the shares held within the portfolio and never the actions of the investor shopping for into or out of these shares (inflows and outflows) or the affect of the dimensions of these actions over the interval being measured.

For extra data and examples, see our video information under:

Why Sharesight makes use of a money-weighted fee of return methodology

At Sharesight, we imagine the time-weighted fee of return methodology is each much less helpful and probably deceptive for particular person traders, who do management when money flows out and in of their portfolios. We imagine a money-weighted efficiency methodology will allow you to greatest analyse the true efficiency of your funding portfolio and the way your selections — the inflows (buys) and outflows (sells) out of your portfolio — have contributed to the returns you will have achieved as an investor.

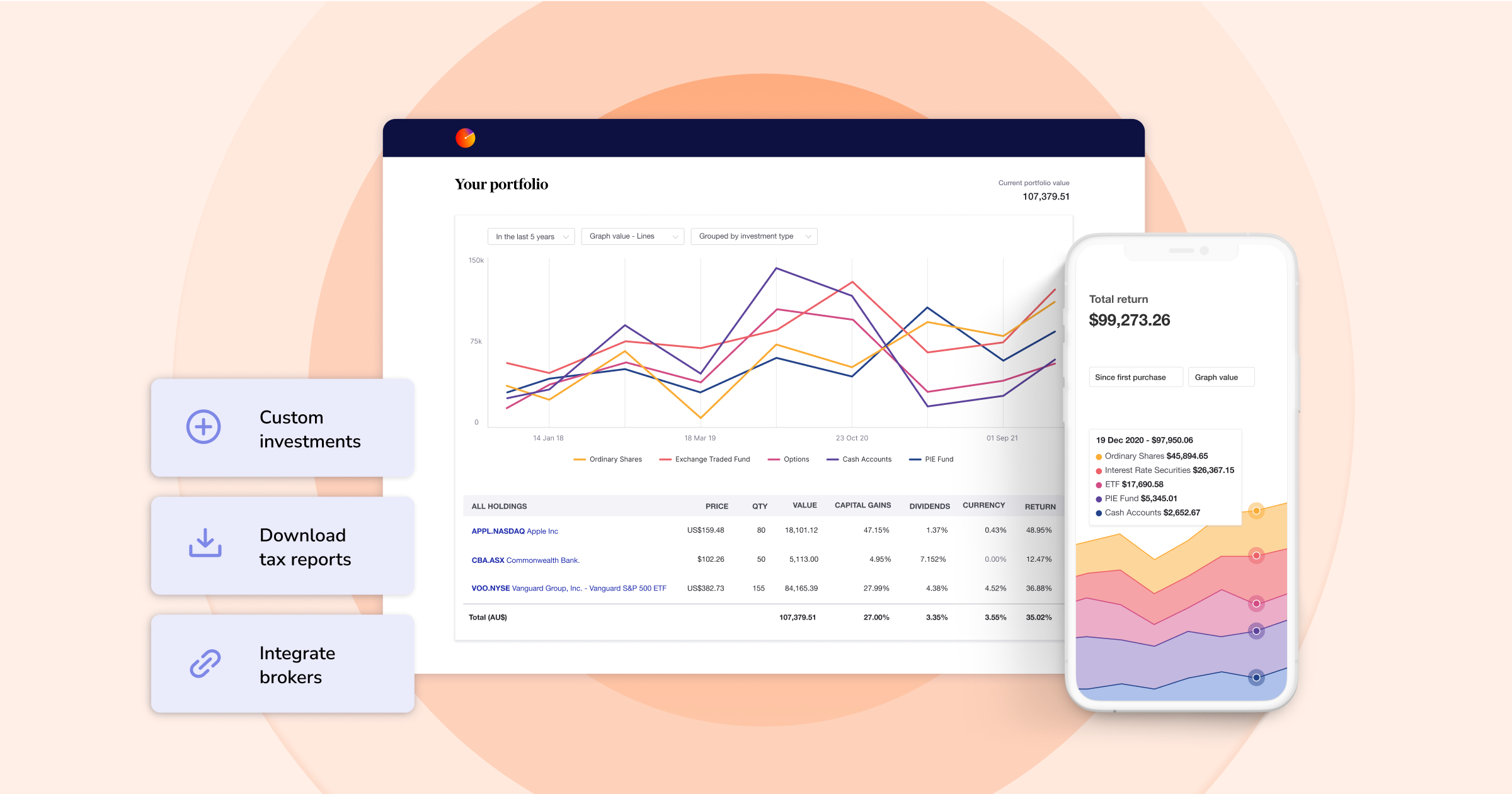

Get the complete image of your returns with Sharesight

A whole bunch of hundreds of traders like you might be already utilizing Sharesight to trace the efficiency of their investments. What are you ready for? Join so you may:

- Observe your entire investments in a single place, together with shares, mutual/managed funds, property and even cryptocurrency

- Mechanically observe your dividend and distribution earnings from shares, ETFs and mutual/managed funds

- Run highly effective studies constructed for traders, together with efficiency, portfolio range, contribution evaluation, publicity, danger, multi-period, multi-currency valuation report and future earnings

- See the true image of your funding efficiency, together with the affect of brokerage charges, dividends, and capital beneficial properties with Sharesight’s annualised efficiency calculation methodology

Join a FREE Sharesight account and get began monitoring your funding efficiency (and tax) at this time.