Disclaimer: This text is for informational functions solely and doesn’t represent a particular product advice, or taxation or monetary recommendation and shouldn’t be relied upon as such. Whereas we use affordable endeavours to maintain the data up-to-date, we make no illustration that any data is correct or up-to-date. In case you select to utilize the content material on this article, you achieve this at your individual danger. To the extent permitted by regulation, we don’t assume any accountability or legal responsibility arising from or related together with your use or reliance on the content material on our website. Please examine together with your adviser or accountant to acquire the proper recommendation on your state of affairs.

An preliminary public providing (IPO) is among the most anticipated occasions in an organization’s development journey — not only for its founders and management group, but additionally for retail traders. It’s straightforward to get caught up within the hype, overlooking essential details on the danger of lacking out on what might be a really promising new addition to the market. However as a rule, investing in an IPO with out doing the analysis or timing your entrance accurately results in disappointment. On this article, we talk about when it is sensible to spend money on an IPO, and tips on how to method IPOs with a strategic mindset. We additionally take a look at some real-world examples of how IPOs have carried out, plus how Sharesight will help you observe your IPO efficiency and make smarter investing choices.

What’s an IPO?

An preliminary public providing, also called an IPO, happens when a personal firm provides shares to the general public for the primary time. The primary goal of that is to boost capital which can be utilized to fund development, scale back debt or enable early traders to make a revenue. For retail traders, an IPO represents the chance to get in early on an organization’s journey within the public markets.

The danger and reward of investing in IPOs

Traders are usually drawn to IPOs as a result of potential of outsized returns. Whereas that is the best-case situation, it’s usually not the truth. Many IPOs underperform of their early months (and even years) as markets transfer past the preliminary hype and reassess the corporate’s true worth. That is generally known as the “IPO pop and drop” impact.

Some real-world examples embrace:

-

Fb (NASDAQ: META) had a shaky IPO in 2012, with technical points and an initially overhyped valuation. The inventory traded flat and underneath its provide value for over a 12 months earlier than recovering and happening to ship robust long-term returns.

-

Uber (NYSE: UBER) debuted in 2019 at $45 per share, however its value dipped considerably post-IPO, reflecting ongoing uncertainty round profitability and regulatory danger. Solely years later has it proven extra constant efficiency.

-

Latitude Monetary (ASX: LFS), one in all Australia’s greatest IPOs lately, listed beneath its anticipated vary in 2021 and has since skilled challenges associated to broader shifts in shopper credit score and lending.

-

Deliveroo (LSE: ROO) listed within the UK in 2021 however misplaced over 30% of its worth on the primary day of buying and selling, highlighting investor issues round governance and the gig economic system.

Dos and don’ts of IPO investing

Do your analysis

Earlier than shopping for into an IPO, it’s necessary to rigorously take into account the corporate’s prospectus. Look past the expansion story — perceive the dangers, money movement, margins, aggressive panorama and what the IPO’s earnings will likely be used for.

It’s additionally advisable that you simply regulate whether or not insiders or personal traders are promoting a good portion of their holdings. Heavy insider promoting might be an indicator that the traders see higher worth in cashing out on their shares than holding long-term.

Don’t fall for the hype

Simply because an organization is high-profile or receives plenty of media hype doesn’t imply it’s funding. The recognition of the model isn’t essentially an indicator of stable financials or a robust valuation.

Monitor value stability post-IPO

In lots of circumstances, IPO shares are topic to a lock-up interval (normally 90–180 days) throughout which insiders can not promote. As soon as this era is over, elevated provide could cause costs to drop. Ready 6–18 months post-IPO can usually present a greater image of the corporate’s efficiency as soon as the hype has died down.

Don’t overlook the broader market context

The result of an IPO depends upon extra than simply fundamentals — additionally it is largely influenced by broader market circumstances. In bull markets, IPOs are inclined to carry out higher, whereas bearish or unstable markets could cause even robust firms to battle. For example, the previous few years has seen a number of high-profile IPOs postponed or pulled altogether on account of market uncertainty.

Use instruments to trace and monitor

In case you’re inquisitive about an IPO however you don’t wish to bounce in immediately, you may add it to your watchlist. Monitoring how a newly-listed inventory performs over time is an efficient technique to achieve perception and enter at a extra applicable valuation level.

How Sharesight helps IPO traders

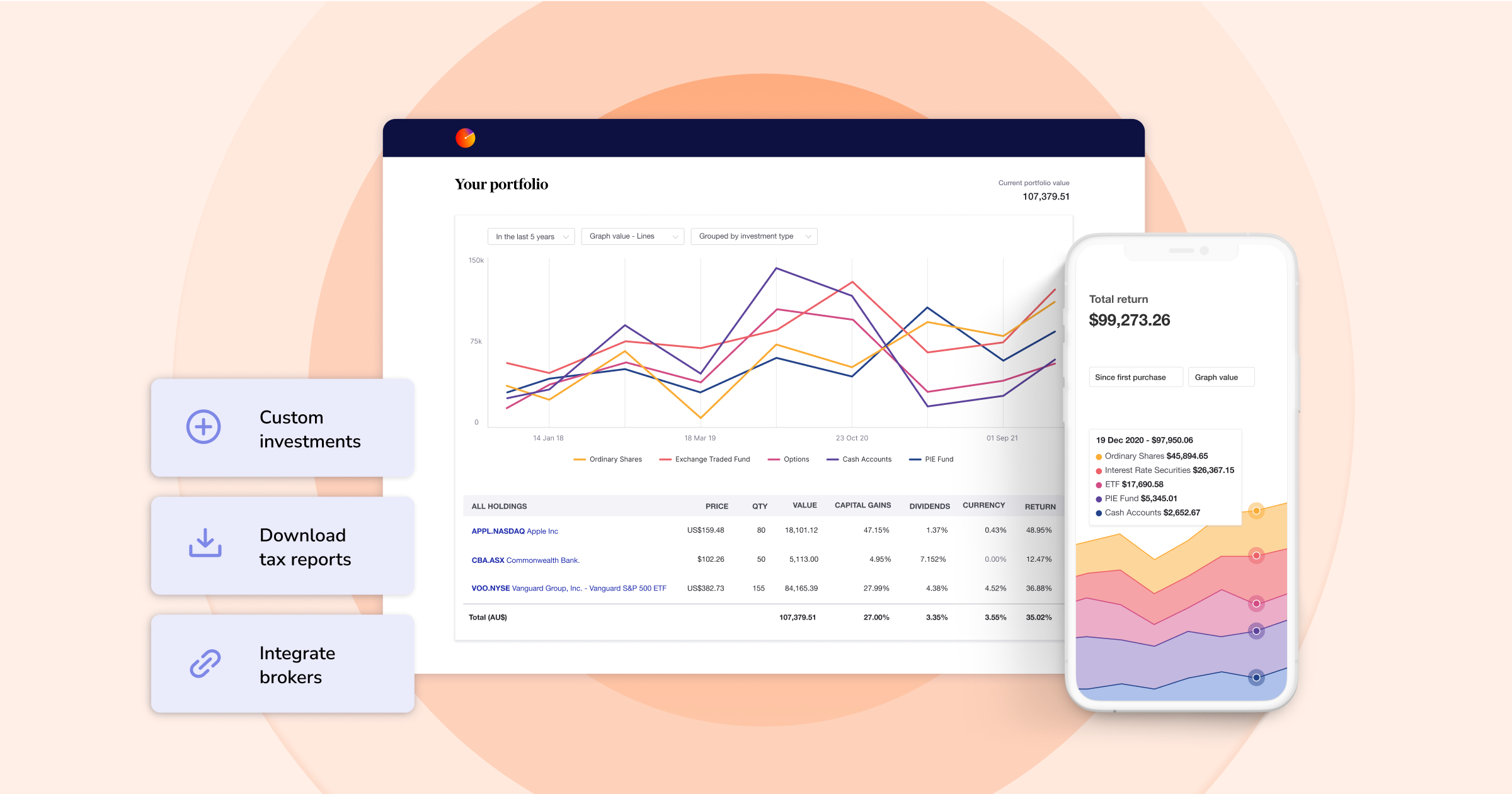

Sharesight takes the complexity out of IPO investing and portfolio monitoring, with help for 60+ main markets, over 200 world brokers and greater than 100 totally different currencies.

With Sharesight, you may:

- Monitor the true efficiency of all of your investments, together with IPOs, with automated dividend monitoring, capital positive aspects and forex results.

- Use the share checker to analyse the historic efficiency of a listed firm. This contains dividends, company actions and main information which will have influenced value actions — invaluable context for IPOs as soon as they’ve been buying and selling for some time.

- Create a watchlist within the Sharesight cellular app to observe IPOs you are inquisitive about, serving to you observe their efficiency earlier than committing capital.

- Create customized labels to focus on IPOs in your portfolio, permitting you to trace their progress at a look.

- Run the publicity report back to see the underlying holdings of any ETFs in your portfolio. This helps decide whether or not there’s any hidden overlap in your portfolio, which may make investing in sure IPOs redundant.

- Run the drawdown danger report to judge the risk-adjusted returns of your IPOs towards the remainder of the property in your portfolio.

The takeaway

IPOs can provide thrilling alternatives, however they arrive with distinctive dangers — from volatility to overvaluation. The secret is to keep away from making choices based mostly on hype. Keep rational, do your analysis and lean on instruments like Sharesight that will help you keep knowledgeable.

By monitoring IPOs and ready for the suitable entry level, you may sidestep the noise and concentrate on long-term worth, regardless of if you resolve to speculate.

In case you’re not already utilizing Sharesight, join a free account to begin monitoring your efficiency, plus achieve entry to a collection of reporting instruments that provide the insights you have to make smarter funding choices.