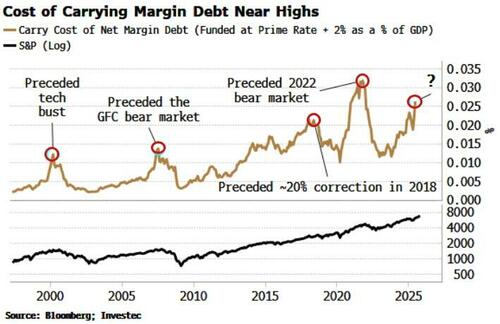

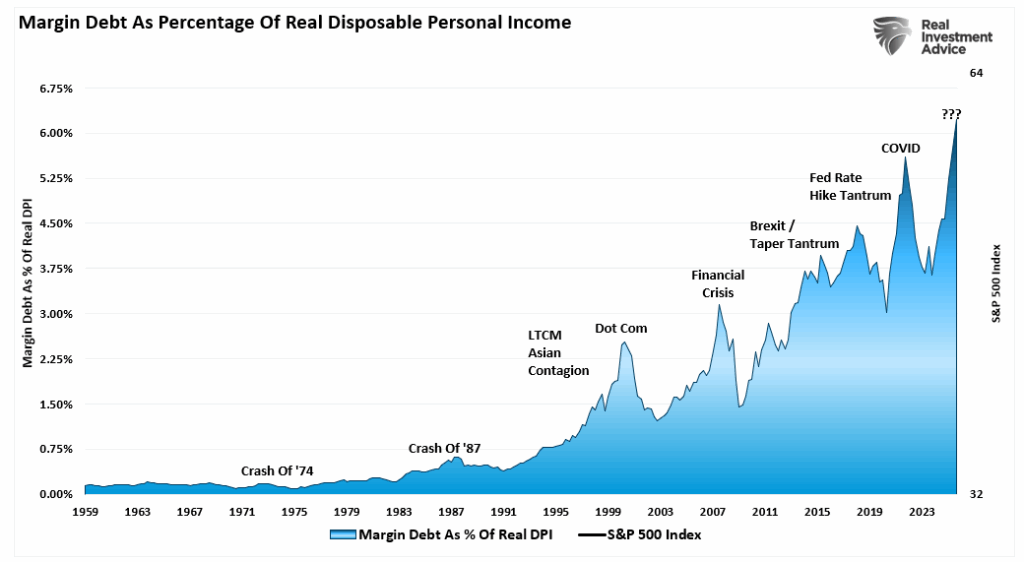

A current article by Simon White, by way of Bloomberg, mentioned the rising value of margin debt for buyers. Whereas his evaluation beneath compares the price of debt to GDP, we will even contemplate a extra vital comparability to disposable private earnings (DPI). Right here is Simon’s level.

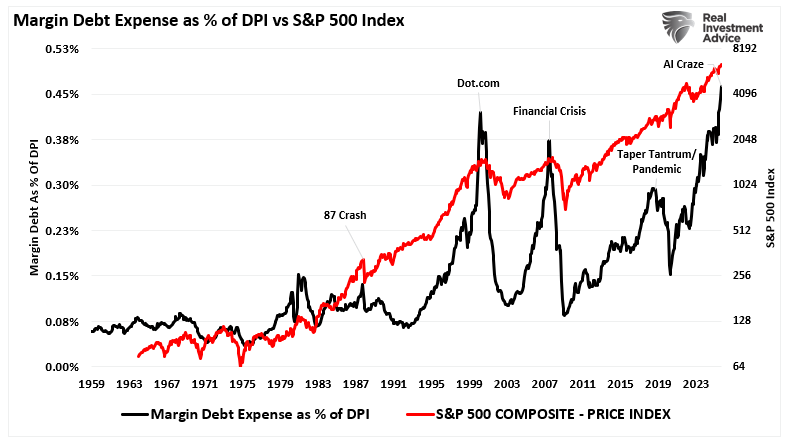

“But, the place historical past does elevate a crimson flag is that if we take a look at the price of carrying the margin debt. Primarily based on an thought from Investec Analysis, we will estimate the full value of carrying margin debt versus GDP (I additionally regulate margin debt for credit score balances). This internet margin debt has solely been larger within the pandemic, when financial savings went by means of the roof. As we will see, cost-of-carry peaks for internet margin debt have preceded important downward strikes in shares: the tech bust in 2000, the GFC bear market in 2008, the close to 20% correction in 2018 and the 2022 bear market.“

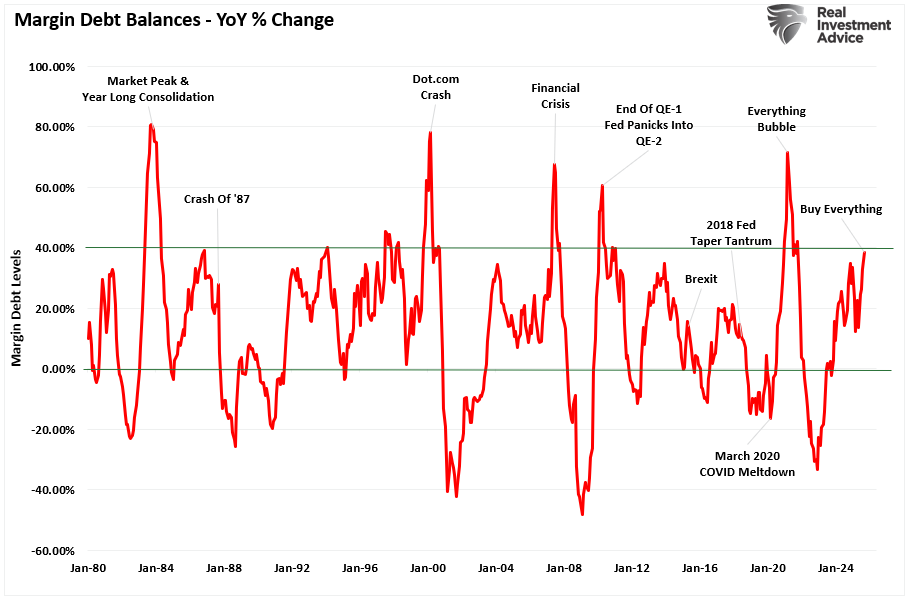

Earlier than we proceed with our dialogue, margin debt now stands at a report of greater than $1.1 trillion, up practically 40% on an annual foundation.

Why is that vital? It’s important to reiterate a vital level about margin debt.

“Margin debt will not be a technical indicator for buying and selling markets. What it represents is the quantity of hypothesis occurring out there. In different phrases, margin debt is the “gasoline,” which drives markets larger because the leverage gives for the extra buying energy of property. Nonetheless, leverage additionally works in reverse, because it provides the accelerant for extra important declines as lenders “drive” the sale of property to cowl credit score traces with out regard to the borrower’s place.

The final sentence is an important. The problem with margin debt is that the unwinding of leverage is NOT on the investor’s discretion. That course of is on the discretion of the broker-dealers that prolonged that leverage within the first place. (In different phrases, when you don’t promote to cowl, the broker-dealer will do it for you.) When lenders concern they could not recoup their credit score traces, they drive the borrower to place in additional cash or promote property to cowl the debt. The issue is that “margin calls” typically occur concurrently, as falling asset costs impression all lenders concurrently.“

In different phrases, the chance with margin debt is:

“Margin debt is a double-edged sword, and the sting that cuts you, cuts the deepest.”

So, why are we discussing this? As a result of margin debt ranges are reaching a degree the place ahead market returns are considerably decrease.

Which brings us again to Simon White and the price of carrying margin debt.

The Hyperlink Between Disposable Private Revenue and Margin Debt

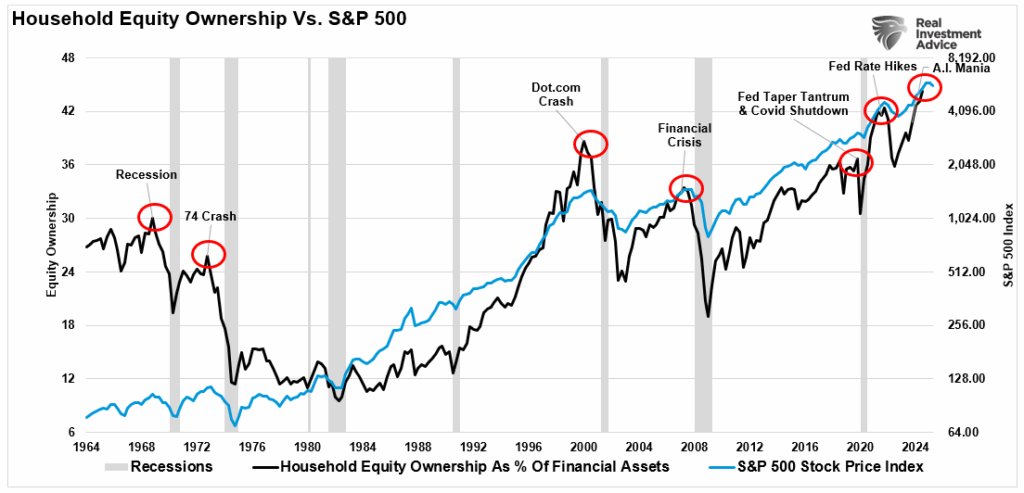

At the moment, family allocations to equities are at a report. In fact, such needs to be unsurprising given the robust market advances over the previous few years.

There’s extra to this story than simply rising asset costs. When buyers are chasing a bull market, they initially make investments their financial savings within the monetary markets. If costs proceed to rise, they then flip to margin debt to proceed investing. Nonetheless, as famous above, that could be a “bullish profit” to the market because the leverage will increase buyers’ “shopping for energy.”

Nonetheless, margin debt will not be “free,” and usually carries an rate of interest that’s two proportion factors above the financial institution’s “prime lending” charge. At the moment, the financial institution’s prime lending charge is round 7%, which suggests that the majority margin debt is carrying an rate of interest of 9%. Subsequently, buyers should contemplate the rate of interest danger related to the borrowed capital to generate a revenue. Over the past three years, returns of 10% or extra have been comparatively simple, not less than to this point.

However that brings us to our warning. Understanding the hyperlink between disposable private earnings (DPI) and margin debt is essential for assessing market danger. DPI is the earnings households have after taxes, out there for saving or investing. When DPI development slows, households have fewer contemporary financial savings to deploy. On this context, some buyers flip to margin borrowing to keep up or enhance publicity.

Within the second quarter of 2025, U.S. Disposable Private Revenue (DPI) stood at roughly $22.858 trillion on a seasonally adjusted annual charge foundation. This determine represents a nominal enhance from $22.564 trillion in Q1 2025. Whereas that development suggests earnings ranges are nonetheless rising, additional information paint a extra nuanced image of investor capability and market danger. Actual disposable private earnings (adjusted for inflation) for Q2 2025 grew by about 3.1% 12 months‑over‑12 months. This development charge stays beneath the lengthy‑time period common of roughly 3.44%. In sensible phrases, households are seeing slower development of their “cash left over” after taxes and primary prices, lowering the circulation of recent financial savings that could possibly be invested.

Margin debt as a proportion of actual DPI has been reported at round 6.23 %, the best on report. This ratio additionally means that for each $100 of actual DPI, roughly $6 of margin debt is excellent, a non‐trivial quantity.

Naturally, when contemporary financial savings are missing and buyers flip to margin to take part in markets, two dangers emerge.

- The standard of the investor base weakens as a result of borrowed cash replaces financial savings.

- The carrying value of that borrowing turns into extra salient when rates of interest are elevated. If the margin debt carries larger curiosity and buyers’ earnings development is weak, servicing the debt turns into more durable, lowering the buffer towards loss.

In abstract, weak DPI development, mixed with elevated margin borrowing, creates a vulnerability. In such an surroundings, the investor base is far much less resilient.

The “Price Of Carry”

Lately, not solely has margin debt surged, however the “value of carrying” that debt has additionally risen. As borrowing prices enhance, the break‐even level for leveraged fairness publicity rises. If an investor borrows at a better rate of interest and the market stagnates or declines, the drag from curiosity and margin mortgage prices erodes returns. Simon’s view of carrying prices as a proportion of GDP is appropriate. Nonetheless, one other salient perspective is to contemplate them as a perform of DPI. In different phrases, if an investor account is absolutely invested, margin curiosity have to be paid both by promoting property or from disposable earnings.

With margin debt expense as a proportion of DPI on the highest degree on report, the chance of market reversal turns into elevated. Greater rates of interest additionally imply that margin borrowing turns into much less engaging relative to different makes use of of capital. If margin charges rise, buyers holding distinguished borrowed positions might face larger servicing prices and elevated strain within the occasion of a correction. In such an surroundings, as proven above, the historic final result has been one in every of elevated monetary fragility.

Furthermore, elevated charges can suppress earnings development throughout the economic system, lowering incentive returns and market momentum. For leveraged buyers, slower earnings development makes it more durable to soak up the price of borrowing. Subsequently, from a market‑construction perspective, the mix of excessive margin debt and excessive borrowing prices creates a vulnerability:

- Leverage is larger.

- Investor earnings development is weaker.

- The carrying value of debt is larger.

These three elements kind a suggestions loop: excessive prices and weak earnings scale back investor resilience; a market drawdown triggers margin calls, which in flip speed up the decline by means of compelled promoting. Educational fashions of margin buying and selling point out that one of these suggestions loop can rework a modest correction right into a sharper decline.

Thus, rising carrying prices of margin debt amplify the chance embedded within the margin debt–DPI hyperlink.

Implications for Buyers and Portfolio Technique

In an surroundings the place the bull market is being fueled by rising margin debt and modest earnings development, buyers face a fragile steadiness. You don’t must exit the market, however you do have to be extra conscious of the dangers. Recognizing how leverage influences market habits and the way shifts in private earnings and debt servicing prices work together with that leverage is vital to defending capital and adjusting expectations.

The truth is that this: buyers are nonetheless chasing returns, and the market continues to reward that habits for now. Rising asset costs, particularly in large-cap tech and momentum-driven sectors, are being supported by a rising use of borrowed cash. Margin debt is climbing, not as a result of family incomes are surging, however as a result of many buyers have restricted financial savings and are reaching for returns by means of leverage.

Subsequently, when you can nonetheless take part on this market, you could stay disciplined.

- Keep invested, however with safeguards. If you wish to stay uncovered to equities, concentrate on high quality, corresponding to robust steadiness sheets, free money circulation, and constant earnings, which matter extra when leverage is elevated. Cut back publicity to speculative names or extremely unstable trades that entice margin-fueled momentum.

- Know your leverage publicity. Even when you aren’t utilizing margin straight, you may be uncovered not directly by means of funds or ETFs that embrace extremely leveraged or sentiment-driven holdings. A overview of your portfolio’s beta and sector focus can assist you gauge that.

- Watch the alerts. Regulate shifts in disposable private earnings development, margin debt traits, and rate of interest coverage. If DPI development turns detrimental, or margin debt begins to contract quickly, that’s an indication that liquidity is drying up. These moments usually precede corrections. Additionally, look ahead to margin name exercise reported by brokers and spikes in volatility indexes, such because the VIX.

- Increase money selectively. When markets are rising however pushed extra by leverage than earnings development, trimming income and elevating cash doesn’t imply market timing—it means danger administration. A modest money buffer can assist you act decisively if a dislocation creates alternatives or threats.

- Respect rate of interest sensitivity. As charges stay elevated, the price of carrying margin debt will not be trivial. If the Fed raises once more and even holds at present ranges, the drag from curiosity expense will develop in a flat or declining market, which may rapidly flip into compelled liquidation for closely leveraged buyers.

- Deal with the development, however put together for the flip. A market constructed on borrowed cash can climb larger than anticipated, however the flip usually comes quick. If the information present growing margin utilization whereas earnings development stalls or turns detrimental, that’s your cue to maneuver from offense to protection.

In brief, the present bull run will not be totally natural. It’s partially fueled by borrowing, supported by sentiment, and closely influenced by the assumption that the Federal Reserve will at all times intervene. The idea of “ethical hazard“ has led to historic excesses in numerous varieties, which have, with out fail, finally resulted in disappointing outcomes.

That doesn’t imply it ends tomorrow, however it does imply it is best to keep alert. Participation is ok—complacency will not be. When the gasoline for the rally is credit score, quite than money circulation, historical past reveals that reversals are swift and unforgiving.

Keep within the recreation, however preserve your guard up.

,