Beginning within the aftermath of the 2008 monetary disaster, a profound change to the Fed’s liquidity-providing function within the capital markets was underway. We will sum up the Fed regime change with a well-liked quip: The Fed has shifted from lender of final resort to the lender of solely resort!

In our articles QE Is Coming and its follow-up, How The Fed Offers Liquidity, we talk about why the Fed has change into the first supplier of liquidity since 2008 and the instruments it makes use of to take care of ample liquidity within the markets. Whereas that Fed regime change has been extremely impactful on the monetary markets, there’s a rising risk of one other significant regime change that would show equally impactful.

This text, like the 2 linked above, is dry. Nonetheless, traders at the moment should perceive that financial coverage has change into a major driver of liquidity, which in flip considerably influences asset costs. And not using a clear understanding of what the Fed is doing and the way it features, your funding concepts, regardless of how strong, will be flawed.

Groupthink Has Been The Fed Norm

The Fed’s financial policy-setting group, the Federal Open Market Committee (FOMC), meets each six weeks to debate the economic system, monetary markets, liquidity, and a bunch of different elements that assist the Fed set financial coverage to satisfy its inflation and employment goals.

After two days of knowledge evaluation, dialog, and debate, the FOMC’s voting members vote on whether or not to regulate financial coverage. Most frequently, the coverage modifications contain the Fed Funds Charge and or the month-to-month tempo of QE or QT.

The committee is comprised as follows:

- Seven members of the Board of Governors- together with the Chairman

- 4 rotating regional Fed Presidents

- The President of the New York Fed

Whereas there are debates and plenty of divergent views expressed on the FOMC conferences, the revealed outcomes all the time give the impression of settlement. That is evident within the assembly assertion, which lists the members who voted for the financial coverage actions and those that dissented. The instance beneath from the October 29, 2025, assembly reveals that two of the twelve members dissented or voted in opposition to the prescribed coverage actions.

Voting for the financial coverage motion have been Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michael S. Barr; Michelle W. Bowman; Susan M. Collins; Lisa D. Cook dinner; Austan D. Goolsbee; Philip N. Jefferson; Alberto G. Musalem; and Christopher J. Waller. Voting in opposition to this motion have been Stephen I. Miran, who most popular to decrease the goal vary for the federal funds fee by 1/2 share level at this assembly, and Jeffrey R. Schmid, who most popular no change to the goal vary for the federal funds fee at this assembly.

Historic Dissents

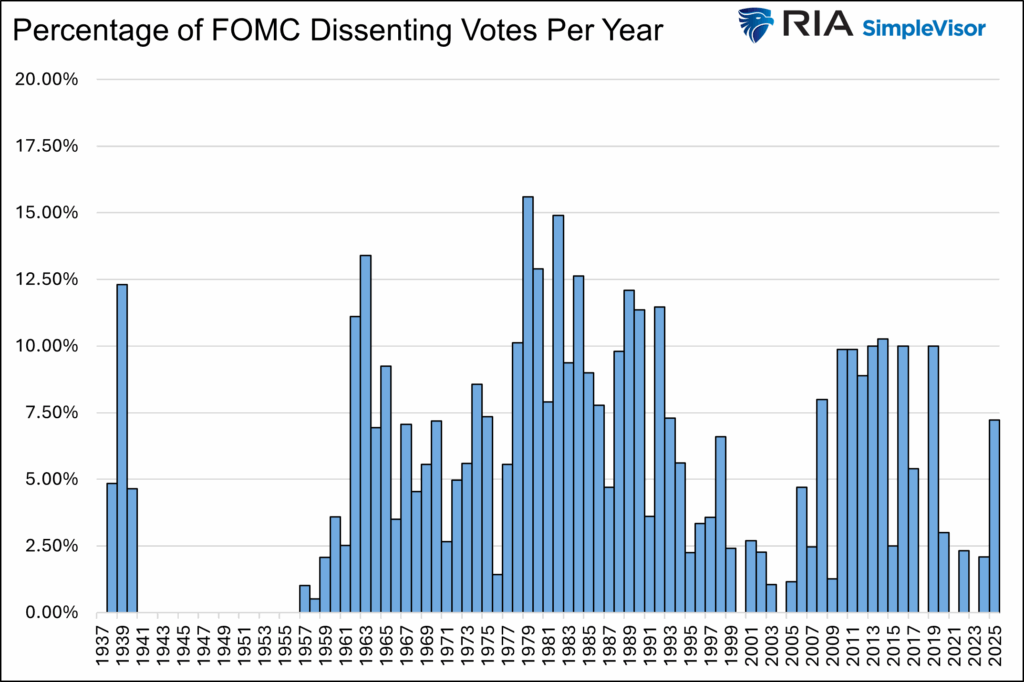

As we shared above, there have been two dissenting votes on the final assembly. On common, since 1936, 5% of members have solid dissenting votes per assembly. Since 2000, essentially the most dissenting votes at a single assembly have been three. On common, over the past 25 years, the percentages are 50/50 that one member will dissent at every assembly.

The underside line is that dissents happen with some regularity, however the votes for or in opposition to coverage motion are all the time a robust consensus. Extra merely, the Fed has been in a groupthink regime fro the final 100 years!

Consensus At The Fed

Within the FOMC minutes, launched three weeks after the assembly, we acquire a greater understanding of the debates that happened. It’s clear from these minutes that there are a lot of divergent opinions. This shouldn’t be stunning, because the members come from totally different areas throughout the nation and have numerous financial views. This has been the case since 1936, when the Fed started sharing the minutes.

Whereas there could also be many views on the economic system and the precise course for financial coverage, the graph above clearly reveals that the majority Fed members coalesce round a single coverage motion.

Very often, the Fed Chair steers the FOMC towards presenting a consensus view.

Politics At The Fed

We argue that, regardless of its supposed independence from the chief department, the Fed has all the time been political to some extent. Moreover, we should assume that each Presidential nomination of a Fed member is based totally on the nominee’s alignment with the President’s views.

Thus, it’s not surprising that Stephen Miran, Trump’s newest appointee, is arguing for aggressive fee cuts. Moreover, Trump’s doable appointee to exchange Lisa Cook dinner and Chairman Powell when his time period ends in Might will probably additionally maintain dovish views.

Whereas there may be an infusion of dovish voters to hitch current dovish members, there additionally stays a camp of hawkish voters. It seems that many of the dovish-hawkish standoff is a operate of whether or not members are extra involved about conserving a lid on inflation (hawkish) or about stopping a worsening of the labor market (dovish).

Nevertheless, we provide that the controversy could also be turning into political as properly. Is the Fed morphing into entities just like the Supreme Courtroom or Congress which can be politically motivated?

In different phrases, are some dovish members not as involved concerning the labor markets as they seem, and as an alternative pushing for a extra accommodative coverage to assist Trump obtain his financial objectives? Conversely, may some maintain hawkish opinions, not as a result of they worry inflation, however as a result of they disagree with the President’s insurance policies?

Is Consensus Lifeless?

If, as we postulate, the Fed is turning into extra politically divided, may the Fed Chairman be shedding the power to current a bunch consensus? Apparently, the percentages of a fee reduce on the subsequent Fed assembly have been floating between 25% and 85%. These odds have been shifting as numerous Fed members have weighed in on whether or not they could reduce charges on the subsequent assembly. At present, there’s a cut up between these wanting to chop charges and people dissenting from one other reduce in December. A number of members additionally seem undecided. If the Chairman is unable to get the members to achieve a consensus, it’s fairly doable there might be 4, 5, and even six dissenters on the subsequent assembly.

Our Take On Dissents

Traditionally, as we famous earlier, the Chairman will get the FOMC to type a robust publicly dealing with consensus. Doing so offers traders, customers, and enterprise leaders a false sense of confidence that the Fed is absolutely conscious of what’s occurring within the economic system and that it has the precise coverage prescription.

We welcome dissent on the Fed. We welcome change. Groupthink, as managed by one particular person, the Chair, has led to important coverage errors. Whereas the Fed will nonetheless make errors sooner or later, traders, enterprise leaders, and customers will not less than be higher versed in different coverage opinions. As an illustration, a vote with a number of dissenting votes alerts that the Fed is just not assured in its views or insurance policies. Whereas that will make some uneasy, it’s higher to acknowledge their stance than to imagine one thing that isn’t true. Conversely, in an period of a number of dissenting votes, a whole consensus ought to lead traders to assume the Fed has robust confidence in its views and insurance policies.

Abstract

As we mentioned earlier, we welcome a regime change on the Fed. We would like 12 autonomous FOMC members deliberating and voting on Fed coverage. We don’t just like the opinion of 1 particular person, the Chairman, dictating the views and insurance policies of the Fed.

A brand new Fed regime consisting of 12 voting Fed members, voicing their very own opinions and casting votes on what they assume, not what the Chairman needs, could be a welcome change, albeit it would introduce short-term volatility within the monetary markets.

,