Gold costs are hovering. And with every tick larger, increasingly market pundits and traders are popping out of the woodwork, asserting that greenback debasement is the rationale. Is that the right motive, or may gold be in a momentum-fueled speculative bubble like many different property?

The reply has important implications for the value of gold. If the reply is that actuality aligns with present standard perceptions, gold costs—regardless of current will increase—could also be pretty valued and even undervalued. Nevertheless, if the reply reveals that the narrative is critically flawed, gold costs may simply drop by 25-50% or extra. To reply our questions, let’s study the favored definitions of greenback debasement promoted by these supporting the greenback debasement idea to find out if they’re legitimate.

This text doesn’t focus on the rationale of proudly owning gold as a long-term asset. As a substitute, it questions the current bounce in gold costs and whether or not the present ranges are basically justified.

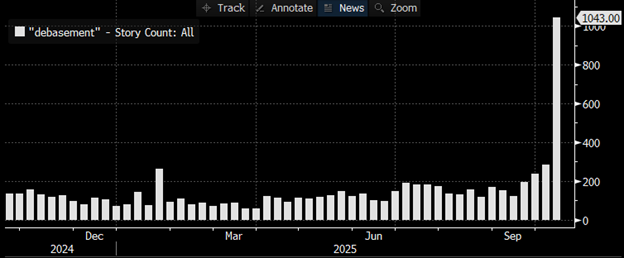

The next Bloomberg graph reveals that the situations of media tales utilizing the phrase “debasement” are hovering.

Defining Greenback Debasement

The next bullet factors are the most well-liked traits of greenback debasement:

- Extreme improve within the cash provide

- Declining buying energy

- Lack of confidence within the forex

As a substitute of assuming all or among the three components are details, let’s quantify them, put them into correct context, and see how nicely the debasement idea holds up.

Earlier than continuing, it’s price noting that the true definition of greenback debasement is totally different than these above. Per our article Debasement: What It Is And Isn’t:

Conversely, debasement implies a structural dilution of a forex’s worth. That is vastly totally different than inflation. In a “debasement” situation, governments take aware actions to cut back the “construction” of the forex. In Rome, for instance, the federal government decreased the quantity of silver in minting cash to extend the variety of cash produced to pay its collectors. Nevertheless, debasement just isn’t a actuality in a fiat system like ours, the place the linkage to gold or silver is nonexistent. In different phrases, when the federal government is “printing paper,” it’s not possible to dilute the “construction.”

No matter which definition of greenback debasement you like, the favored ones, bullet-pointed above, are what assist the surge in gold costs. Accordingly, that’s what issues for this dialogue.

Extreme Improve In The Cash Provide

That is believed to occur when the federal government and/or the central financial institution print rather more cash than the economic system calls for. To understand how that would occur in America, it’s important to acknowledge that neither the Fed nor the federal government prints cash. All cash is lent into existence. Per our article The place Does Cash Come From?:

The cash provide modifications based mostly on the banking system’s willingness and talent to lend cash and customers’ demand and talent to borrow it.

Whereas the Fed doesn’t print cash, it will probably incentivize lending and borrowing, i.e., cash creation, with its insurance policies. They’ll additionally disincentivize cash creation.

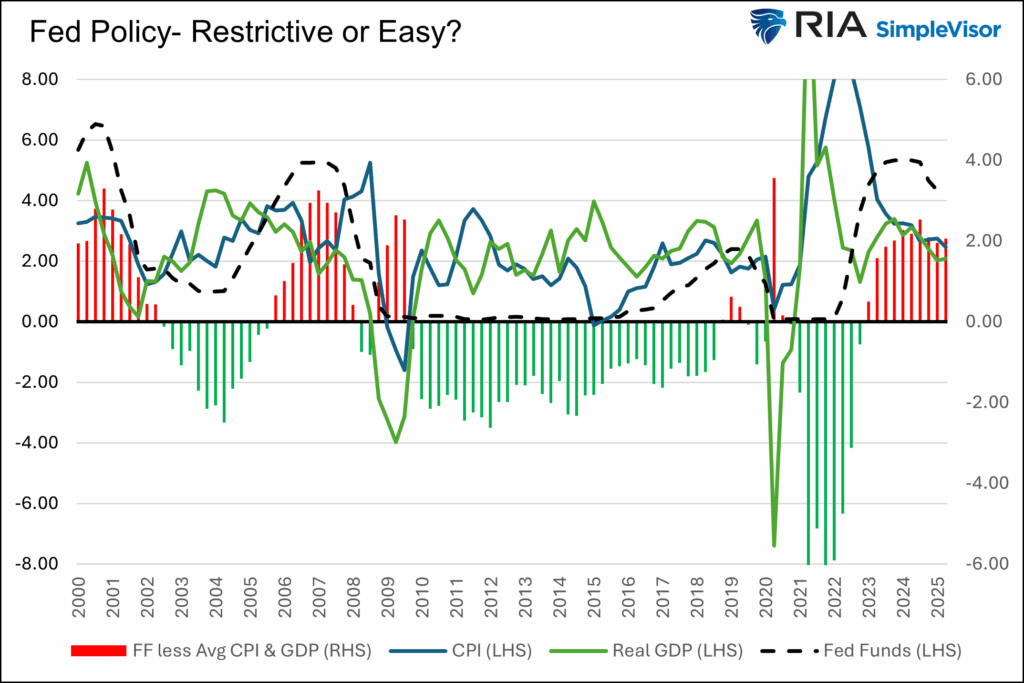

Presently, the Fed is disincentivizing cash creation. As we share under, the Fed’s Fed Funds charge is at the moment nicely above the present and anticipated inflation and financial progress charges. Moreover, the Fed is lowering its steadiness sheet (QT) by $40 billion a month. Doing so leaves banks with fewer reserves to generate loans.

Backside line: the Fed, through restrictive financial coverage, is disincentivizing cash provide progress.

The federal government can borrow cash, which in flip creates cash. One can argue that their huge fiscal deficits over the previous few years must be regarding from a cash provide perspective. Nevertheless, doing so fails to contemplate that banks have restricted reserves. If they’re compelled to purchase authorities debt, which is akin to creating a mortgage, they’ve fewer reserves during which to lend to the general public.

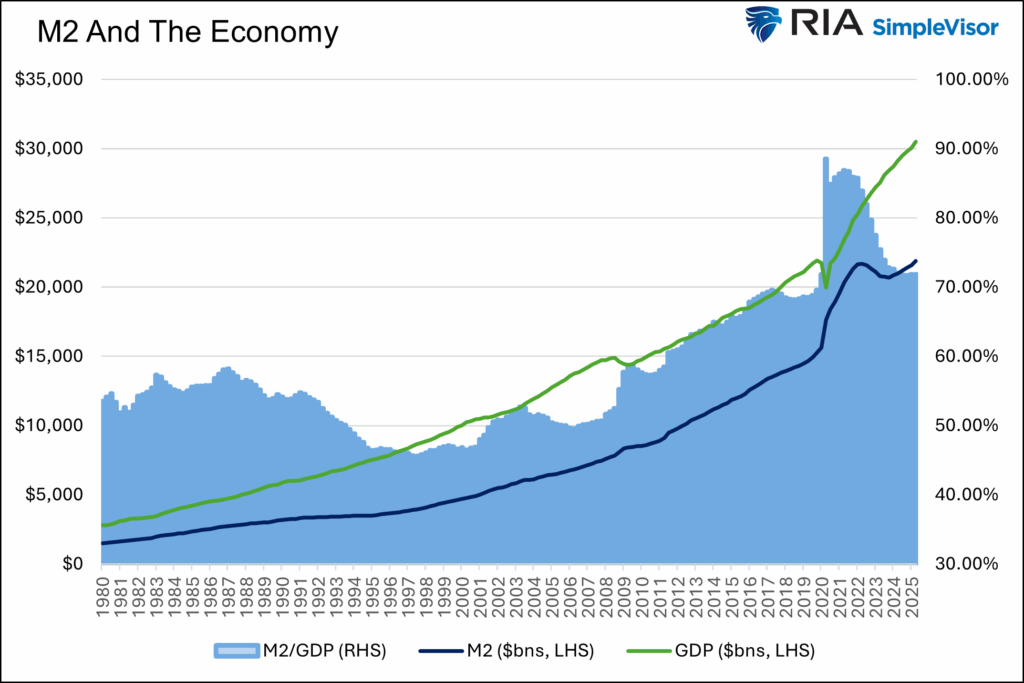

The graph under compares the cash provide (M2) to financial exercise (GDP). Whereas the ratio of M2 to GDP has elevated in current many years, it at the moment stays round its stage in 2016.

There was a spike in M2 associated to the pandemic, however the graph above doesn’t point out that the pattern progress of the cash provide is all of the sudden extreme.

Declining Buying Energy

In 1950, you would go to the films for 50 cents. Right this moment, film tickets can run between $15 and $25. As they are saying, a greenback doesn’t purchase what it used to.

In that respect, the buying energy of the greenback has plummeted. However that argument solely holds for individuals who retailer their {dollars} in a tin can or underneath a mattress. It fails to contemplate our capability to buy. Think about that wages have gone up considerably since 1950. The wealth of the populace has additionally considerably risen.

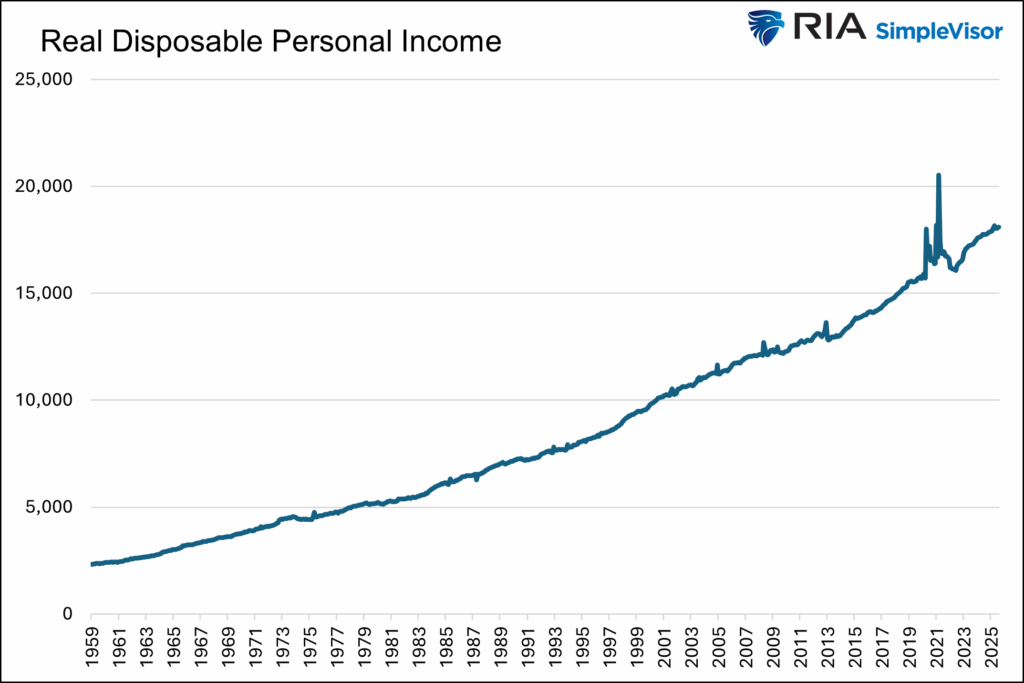

The graph under reveals that actual (after inflation) disposable earnings has grown steadily since 1959. Thus, wages and disposable earnings are greater than maintaining with inflation.

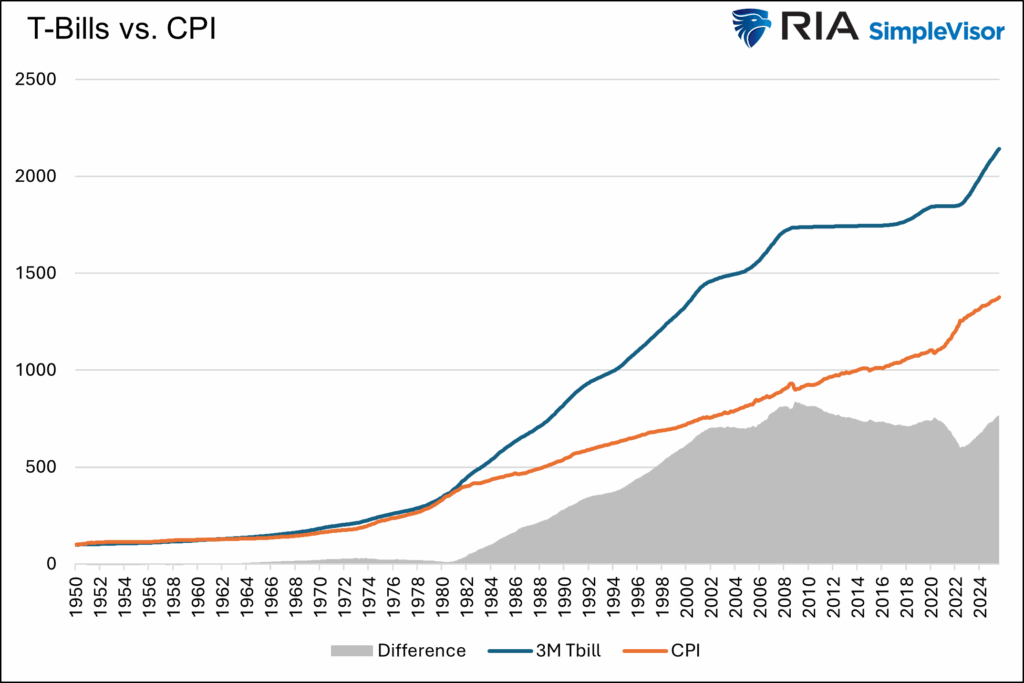

The overwhelming majority of individuals preserve their wealth in a financial institution or brokerage account. The graph under reveals {that a} rolling funding in a three-month US Treasury Invoice since 1950 has outpaced inflation reasonably. Now think about that most individuals’s wealth earns the next charge than that of a Treasury Invoice.

It’s not clear to us that buying energy, together with wages and wealth, has declined. In truth, the usual of residing for each the rich and the poor has improved because the days when it value 50 cents to go to a film.

Loss Of Confidence In The Foreign money

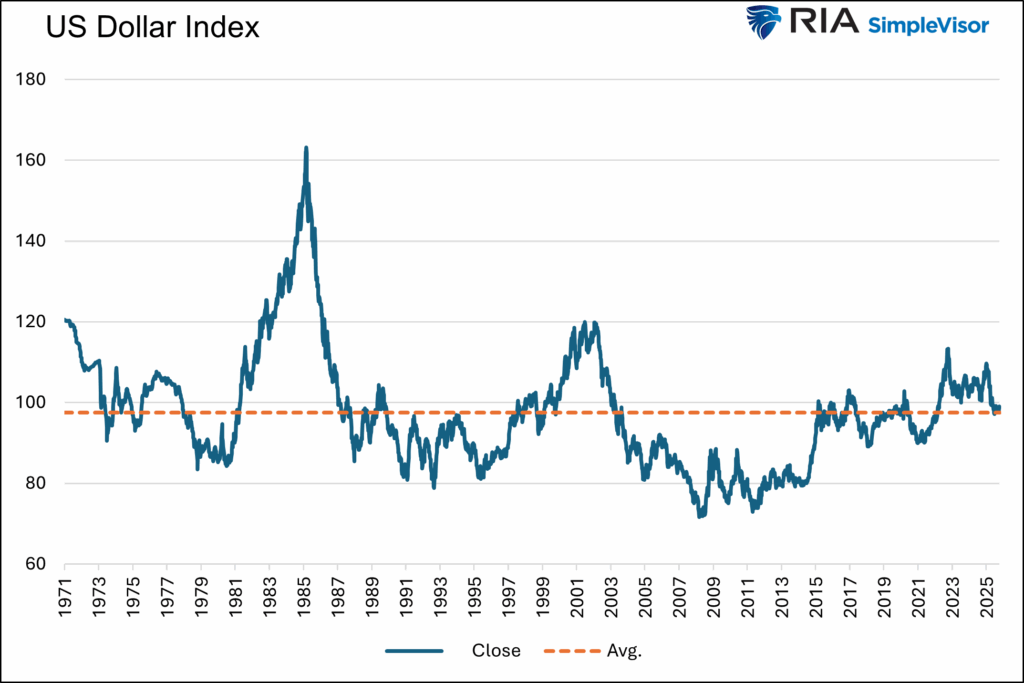

Some pundits consider that the current 10-15% decline within the greenback index is proof sufficient that the greenback is falling out of favor as fiscal deficits and inflation erode its worth. Does the graph under present any proof that the current decline is something out of the norm?

Furthermore, if the forex have been now not trusted, who of their proper thoughts would purchase US Treasury bonds? The actual fact is that bond yields have been drifting decrease regardless of the expansion of the debasement narrative.

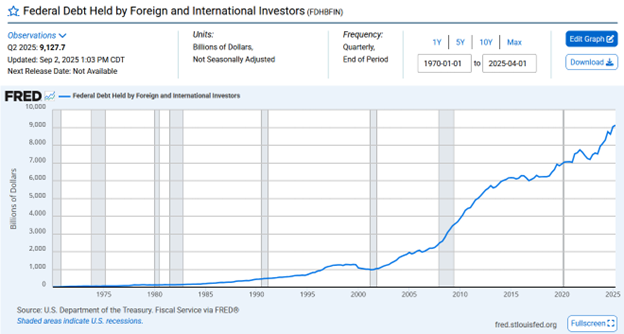

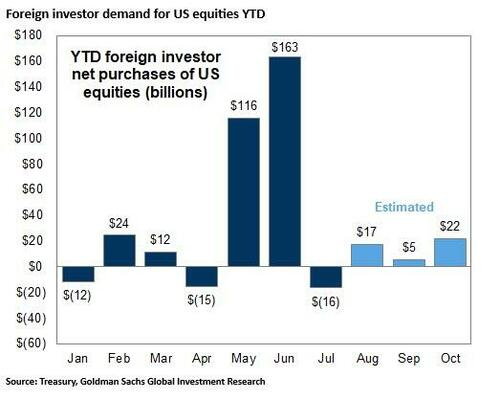

Absolutely, international bondholders would promote Treasury bonds and all dollar-based holdings in the event that they lacked religion within the greenback, proper? The primary graph under reveals that federal debt held by foreigners is at a file excessive. Additional, the expansion charge has picked up over the previous couple of years. The second graph highlights that international traders are shopping for US equities as nicely.

Primarily based on precise financial transactions reasonably than imprecise sentiment readings and rumour, there may be as a lot confidence within the greenback right now as prior to now.

Gold

Regardless of the overwhelming proof we’ve introduced exhibiting that the greenback debasement narrative lacks details, some will argue that gold is the arbiter of the greenback debasement argument. To their level, gold is up 50% this yr and virtually 200% since 2020. They argue that the value of gold is quoted in ounces per greenback. Subsequently, they are saying, the value of gold isn’t rising per se, however the denominator, the greenback, is declining. If that have been true, wouldn’t the costs of commodities and homes be surging too?

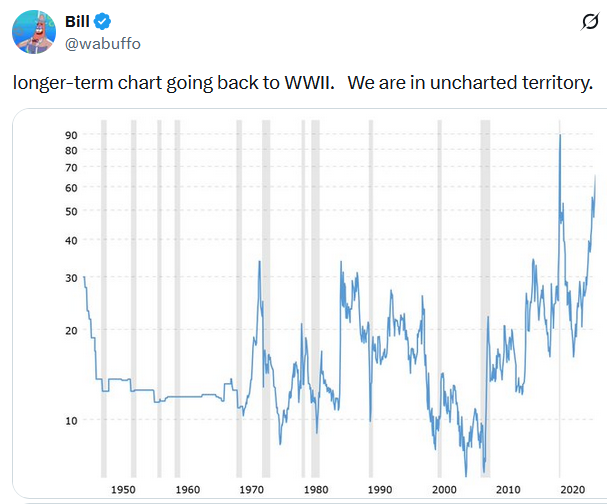

The graph within the Tweet under reveals the value ratio of gold to grease. Oil, like gold, is a tough asset. Why is its value floundering?

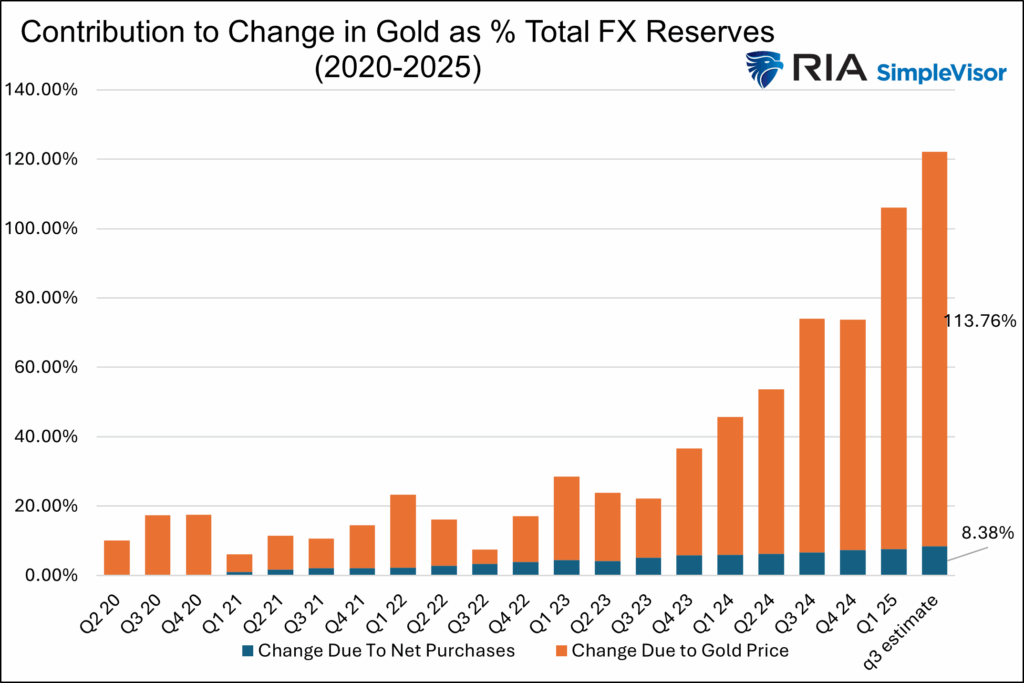

One other standard however deceptive argument is that international central banks’ reserves in gold are rising quickly. That’s true. Nevertheless, as we share, central banks have barely added bodily gold to their gold reserves. As a substitute, gold, as a proportion of reserves, has grown considerably as a result of its value will increase the worth of the gold in comparison with different reserves.

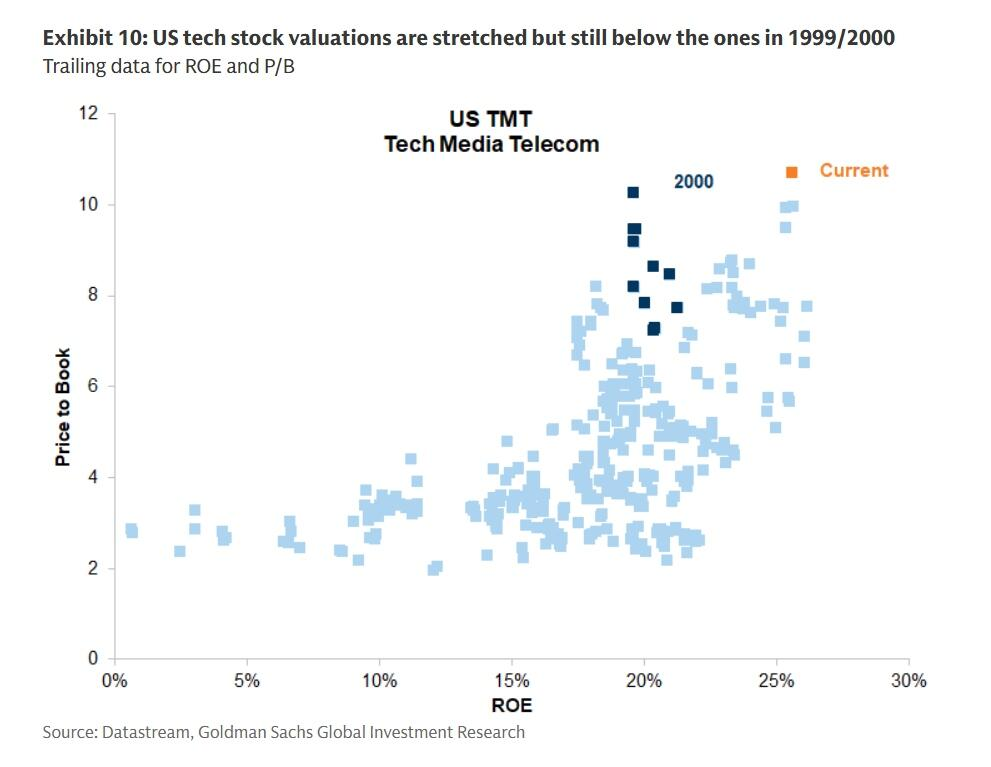

Extremely speculative actions characterize the present funding setting. Gold, like cryptocurrencies, AI-related corporations, meme shares, and a number of different property, is working sizzling as sentiment is uber-bullish.

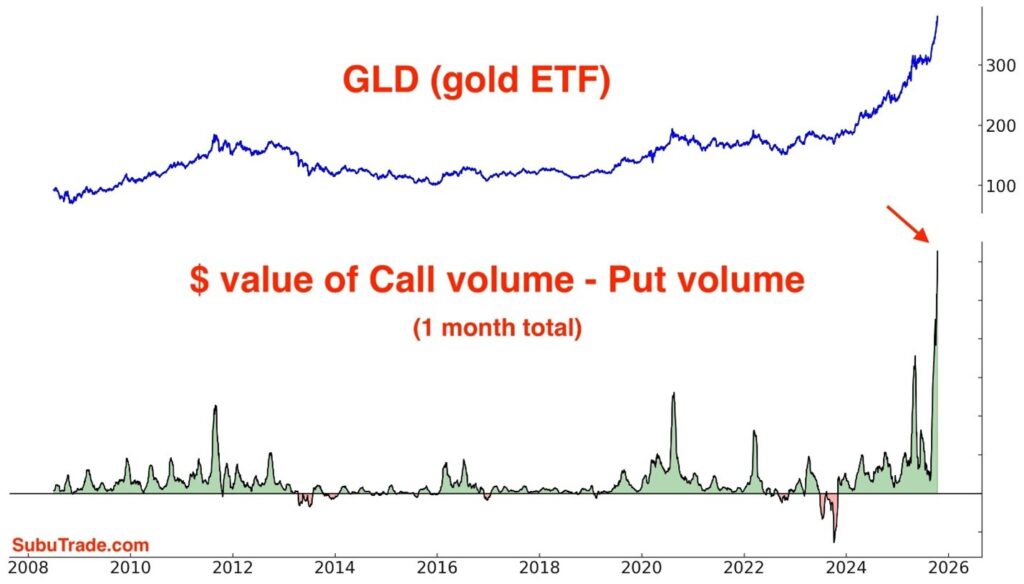

The chart under is courtesy of @SubuTrade. It reveals that the quantity of gold calls exceeds that of places by the widest margin prior to now 15 years. Name consumers are speculative merchants who are likely to comply with narratives reasonably than fundamentals. The file name shopping for displays the extremely speculative enthusiasm within the gold market.

Abstract

Until there’s a new definition of debasement, we see no basic motive for gold to be behaving as it’s. The greenback debasement narrative could preserve gold costs rocketing larger for some time. Nevertheless, don’t lose sight of the truth that gold costs, at such elevated ranges, are extremely inclined to the narrative shedding steam.

When it inevitably does, we should always count on the value to fall again to historic norms. Will that be the 200-day shifting common, which is 25% decrease than present costs? Possibly nearer to $2000, the place gold initially exploded from in early 2024?

We don’t have the reply, however we do know that some revenue taking and danger administration, even for many who consider in greenback debasement, is prudent at present ranges.

,