Pet insurance coverage claims are rising quick. Pet house owners count on pace, vets want fast choices, and insurers should stability all of it with accuracy, fraud management, and value effectivity. Conventional workflows can’t sustain – and neither can spreadsheets.

So how do you progress quicker with out shedding management?

The reply is smarter, data-driven claims automation. By automating claims processing and surfacing insights once they matter most, insurers could make faster, sharper choices and let claims handlers deal with what actually counts. You acquire pace, accuracy, and full management of your claims course of.

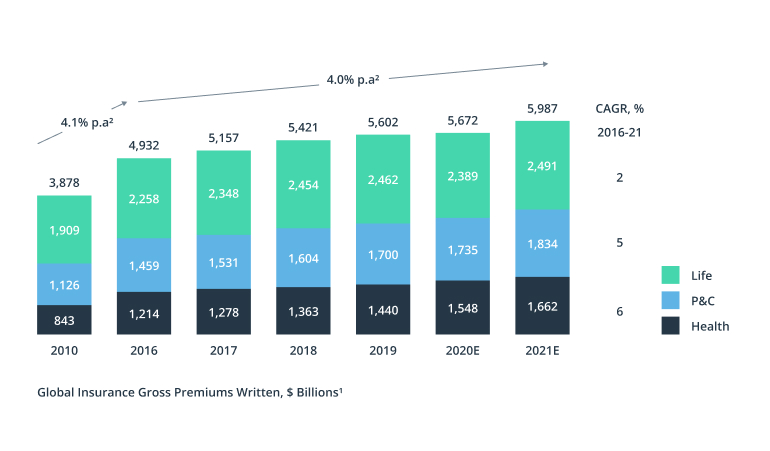

Traditionally, claims dealing with has been gradual and handbook. Piles of vet payments, medical data, and coverage checks. However the previous methods will not sustain with the quickly rising pet insurance coverage market. Claims information shouldn’t sit idle in spreadsheets. It ought to drive your workflows, energy fraud detection, and information smarter, quicker choices.

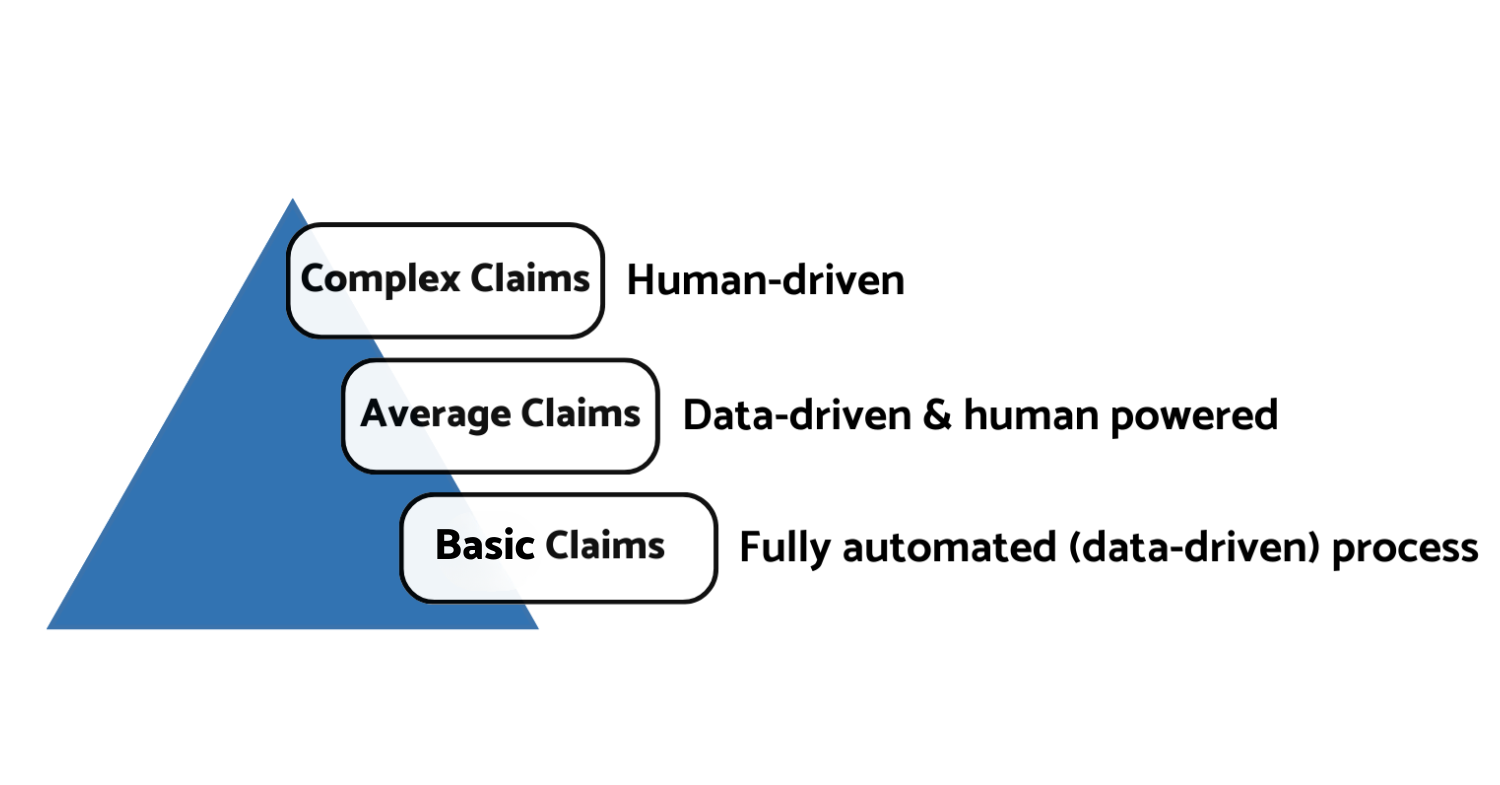

And never each declare deserves the identical degree of consideration. Some want knowledgeable judgment. Others needs to be resolved in seconds. The secret’s figuring out which is which – and constructing a course of that adapts accordingly.

Method relying on Claims Complexity

Overview showcase the best way to categorise claims and allocate sources.

Overview showcase the best way to categorise claims and allocate sources.

Take complicated claims, reminiscent of these involving uncommon situations, continual diseases, or superior surgical procedures. These require human judgment and deeper experience, however that doesn’t imply they will’t be streamlined. Equip your claims handlers with real-time insights: immediately flag inconsistencies, predict prices, and floor related information immediately. The consequence? Much less admin, higher choices, and quicker outcomes.

Then there are common claims. Recurring therapies, allergy medicines, and different frequent however not at all times clear-cut circumstances. These are likely to comply with patterns however can embrace exceptions. The most effective strategy? Mix automation with human oversight. Automate the predictable, like bill checks and coverage validations, whereas flagging outliers for evaluation. That means, you acquire pace with out compromising accuracy.

Lastly, primary claims. These embrace commonplace vaccinations, wellness checkups, and minor reimbursements. These are probably the most frequent and predictable and but are sometimes nonetheless manually reviewed. However they don’t have to be. With straight-through processing (STP), primary claims may be mechanically accepted and settled in seconds. There are not any bottlenecks – simply clear, environment friendly claims dealing with.

You don’t want a full handbook evaluation for each case – you simply want a system good sufficient to know when to step in. With a claims platform designed particularly for pet insurance coverage, your information turns into a choice engine.

You possibly can:

- Auto-settle routine claims immediately

- Pace up decision-making on complicated circumstances

- Spot fraud early, earlier than it turns into a price

- Scale back admin with out sacrificing accuracy

Pet insurance coverage is evolving. Your claims course of ought to too.

Let’s speak about the best way to make that occur to your staff.

,