For traders trying to maximise returns and streamline tax reporting, having the suitable instruments is crucial. Whereas spreadsheets and generic accounting software program could appear adequate, they usually lack the tailor-made options that property traders want. That’s the place purpose-built software program like TaxTank is available in. On this weblog, we discover why property traders ought to use a devoted platform and the way integrating TaxTank with Sharesight can simplify portfolio administration and tax reporting.

![]()

The challenges of property funding administration

Property investments demand much more hands-on administration than shares or ETFs. Past merely shopping for and promoting, landlords and traders should juggle a spread of bills, observe each deductible merchandise, and keep alert to ongoing regulatory modifications. Listed below are 4 key pitfalls of managing property investments manually:

1. Missed or incorrect deductions

Curiosity, upkeep and depreciation rapidly blur collectively with out sturdy monitoring. Neglected or misreported bills imply you’re basically handing additional a reimbursement to the ATO.

2. Capital positive aspects tax & altering guidelines

Renovations, shifting property use, and evolving laws complicate capital positive aspects calculations. Lacking a key element or failing to trace enhancements can imply shedding out on grandfathered advantages, or worse, overpaying on CGT.

3. Missed alternatives with out reside knowledge

Solely reviewing your tax place at 12 months’s finish makes it powerful to tweak methods on the fly. Actual-time perception is vital to maximising deductions, adjusting utilization and seizing mid-year tax benefits.

4. ATO data-matching stress

Superior ATO expertise flags any inconsistencies, from small oversights in expense claims to bigger errors in apportioning curiosity on loans. This raises the danger of audits and penalties, creating each monetary and administrative complications.

Why use a purpose-built answer for property traders?

Property funding software program like TaxTank is designed particularly to deal with the distinctive challenges of property traders, providing options that simplify tax and monetary administration.

1. Actual-time tax monitoring

Not like spreadsheets or conventional accounting software program, TaxTank consolidates all of your properties, portfolios, different property and earnings sources in a single place. Because of ongoing, real-time tax calculations, you’ll be able to monitor your estimated tax place all year long and make strategic choices nicely earlier than tax time.

2. Stay financial institution feeds and market values

TaxTank robotically pulls reside financial institution feeds for easy transaction categorisation, making certain no deductible expense goes unclaimed. Everlasting doc storage retains receipts and invoices organised and audit-ready. With CoreLogic integration, you additionally get real-time market worth estimates and progress forecasts for extra knowledgeable decision-making.

3. Depreciation & borrowing expense monitoring

TaxTank robotically tracks depreciation for buildings, property, renovations and borrowing bills, utilizing good guidelines to maximise claims 12 months after 12 months. With reside reporting of your tax, money circulate and gearing, no helpful deductions slip by means of the cracks, protecting you firmly accountable for your property funding technique.

4. Capital positive aspects tax calculations

When it comes time to promote, TaxTank calculates CGT robotically, factoring in buy prices, enhancements, promoting bills, holding prices for land and related grandfather provisions over time. This helps keep away from costly errors and ensures traders keep compliant with tax laws.

Why not simply use small enterprise accounting software program?

Whereas software program like Xero, MYOB, and QuickBooks are implausible for small companies, they aren’t designed particularly for property traders. These platforms give attention to invoicing, payroll, and enterprise expense monitoring slightly than the distinctive wants of property traders, comparable to depreciation, mortgage curiosity monitoring, and capital positive aspects tax calculations. Utilizing a purpose-built answer like TaxTank ensures you get the suitable instruments for optimising your property funding portfolio.

Integrating TaxTank with Sharesight

For traders managing each property and shares, monitoring efficiency throughout asset courses is usually a problem. That’s why TaxTank integrates with Sharesight, permitting customers to get a whole view of their funding portfolio in a single place.

With the TaxTank and Sharesight integration, traders can:

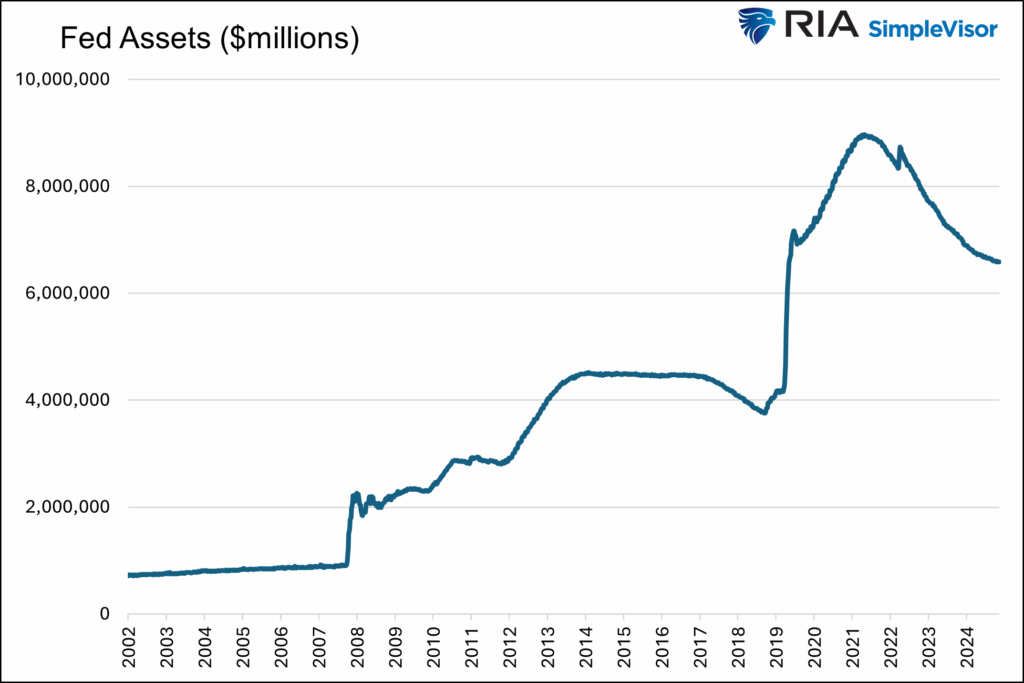

![]() Traders can effortlessly observe all their multi-asset investments in a single place with Sharesight’s portfolio tracker.

Traders can effortlessly observe all their multi-asset investments in a single place with Sharesight’s portfolio tracker.

Get began with TaxTank and Sharesight

When you’re able to simplify your property funding administration, join a TaxTank account at present.

And should you’re not already utilizing Sharesight, create a FREE account to trace your property alongside your shares, ETFs and different investments for an entire portfolio overview.

Disclaimer: This text is for informational functions solely and doesn’t represent a selected product suggestion, or taxation or monetary recommendation and shouldn’t be relied upon as such. Whereas we use cheap endeavours to maintain the data up-to-date, we make no illustration that any info is correct or up-to-date. When you select to utilize the content material on this article, you achieve this at your individual threat. To the extent permitted by legislation, we don’t assume any accountability or legal responsibility arising from or related together with your use or reliance on the content material on our web site. Please test together with your adviser or accountant to acquire the right recommendation to your state of affairs.